| ⚠️ From 4 April 2023, the AMEX HighFlyer Card will no longer award miles for GrabPay top-ups, insurance premiums, public hospital bills or utilities bills. Needless to say, this is a big nerf, and will have implications on whether or not you should get this card. This review will be updated once the new terms go into play. |

Here’s The MileLion’s review of the AMEX HighFlyer Card (also known as the AMEX Singapore Airlines Business Credit Card), the business card for SMEs that might just trigger the entrepreneur in you.

While external (no more GrabPay-AXS) and internal (no more first year fee waiver) developments mean this isn’t quite the same outrageous deal it was from 2019-2022, I’d reckon it’s still an essential card for anyone who’s in a position to get it.

AMEX HighFlyer Card AMEX HighFlyer Card | |

| 🦁 MileLion Verdict | |

| ☑ Take It ☐ Take It Or Leave It ☐ Leave It | |

| With virtually no exclusions (not even GrabPay top-ups) and an Accor Plus membership, this card is an easy decision for anyone who qualifies. | |

| 👍 The good | 👎 The bad |

|

|

| 💳 Full List of Credit Card Reviews | |

Overview: AMEX HighFlyer Card

Let’s start this review by looking at the key features of the AMEX HighFlyer Card

| |||

| Apply | |||

| Income Req. | S$30,000 p.a. | Points Validity | 3 years |

| Annual Fee | S$301.79 | Min. Transfer | N/A |

| Miles with Annual Fee | None | Transfer Partners | HighFlyer |

| FCY Fee | 2.95% | Transfer Fee | None |

| Local Earn | 1.8 mpd | Points Pool? | N/A |

| FCY Earn | 1.8 mpd | Lounge Access? | Yes |

| Special Earn | Up to 8.5 mpd on SIA tickets | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

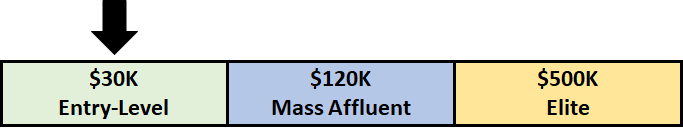

How much must I earn to qualify for an AMEX HighFlyer Card?

The AMEX HighFlyer Card has an annual income requirement of at least S$30,000 p.a., the MAS-mandated minimum to hold a credit card in Singapore.

The real barrier isn’t the income requirement, however. Because this is a business credit card, you’ll need a valid Unique Entity Number (UEN) to apply. This means registering your business with ACRA, be it a sole proprietorship, limited liability partnership or company.

American Express does not require a minimum turnover nor number of employees- if you’re running a home business, giving tuition or engaged in some other side hustle, registering your business with ACRA would qualify you to apply.

The S$30,000 minimum income need not come from the registered business itself. For example, I could earn S$30,000 from my day job with Company A, and have a separate side hustle with my own Company B. I could then apply for an AMEX HighFlyer Card on behalf of Company B, using my income from Company A to qualify.

How much is the AMEX HighFlyer Card’s annual fee?

| Principal Card | Supp. Card | |

| First Year | S$301.79 | S$99.93 |

| Subsequent | S$301.79 | S$99.93 |

The AMEX HighFlyer Card has an annual fee of S$301.79 for principal cards, and S$99.93 for supplementary cards.

While the first year’s fee can no longer be waived, subsequent years’ fees are waivable, subject to approval. I’ve managed to secure fee waivers for the past two years with about S$30,000-40,000 annual spend, mostly on GrabPay top-ups and donations.

How many miles do I earn?

| 🇸🇬 SGD Spend | 🌎 FCY Spend | ➕ Bonus Spend |

| 1.8 mpd | 1.8 mpd | Up to 8.5 mpd on SIA tickets |

SGD/FCY Spend

AMEX HighFlyer Cardholders earn:

- 1.8 HighFlyer points every S$1 spent in Singapore Dollars

- 1.8 HighFlyer points every S$1 spent in foreign currency

1 HighFlyer point is worth 1 KrisFlyer mile, so that’s an equivalent earn rate of 1.8 mpd for local and overseas spend. This makes the AMEX HighFlyer Card one of the highest-earning general spend cards on the market.

| Cards | Local MPD | FCY MPD |

UOB PRVI Miles UOB PRVI Miles | 1.4 | 2.4 |

AMEX HighFlyer Card AMEX HighFlyer Card | 1.8 | 1.8 |

OCBC 90°N MC OCBC 90°N MC | 1.3 | 2.1 |

Citi PremierMiles Citi PremierMiles | 1.2 | 2.0 |

DBS Altitude DBS Altitude | 1.2 | 2.0 |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend | 1.2 | 2.0* |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card | 1.1 | 2.0* |

BOC Elite Miles BOC Elite Miles | 1.0 | 2.0 |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit Card | 1.2 | 1.2 |

| *June and Dec only, otherwise 1.1 mpd | ||

All overseas transactions are subject to a 2.95% FCY fee.

Bonus Spend

The AMEX HighFlyer Card is marketed as earning up to 8.5 HighFlyer points per S$1 on Singapore Airlines and Scoot tickets, but this figure needs some breaking down.

You actually earn only 2.5 HighFlyer points per S$1 from the AMEX HighFlyer Card itself. The remaining 6 HighFlyer points is comprised of:

- The usual 5 HighFlyer points per S$1 awarded to all HighFlyer members

- A bonus 1 HighFlyer point per S$1 awarded to HighFlyer members with the AMEX HighFlyer Card

Moreover, note that these 6 HighFlyer points per S$1 are not awarded on tickets issued in the V or K booking classes (Economy Lite). Tickets issued in the Q or N booking classes (Economy Value) will only be eligible for 50% accrual of HighFlyer points.

HighFlyer points are not earned on award redemptions, so if you’re using the AMEX HighFlyer Card to pay for taxes and surcharges on award tickets, you’ll earn just 2.5 mpd.

When are HighFlyer points credited?

HighFlyer points are credited when your transaction posts, which generally takes 1-3 working days.

How are HighFlyer points calculated?

Here’s how you can work out the HighFlyer points earned on your AMEX HighFlyer Card.

| Local Spend | Multiply transaction by 1.8, then round to the nearest whole number |

| FCY Spend | Multiply transaction by 1.8, then round to the nearest whole number |

The minimum spend to earn points is therefore S$0.28.

If you’re an Excel geek, here’s the formulas you need to calculate points:

| Local Spend | =ROUND (X*1.8,0) |

| FCY Spend | =ROUND (X*1.8,0) |

| Where X= Amount Spent | |

For the full list of formulas that banks use to calculate credit card points, do refer to these articles:

What transactions aren’t eligible for HighFlyer points?

One of the great things about the AMEX HighFlyer Card is how liberal it is with awarding points. The only transactions that don’t qualify are:

- Charges processed and billed prior to the Enrolment Date or charges prepaid on any Card Account prior to the first billing statement for that Card Account following the Enrolment Date

- Cash Advance and other cash services

- Finance charges – including Line of Credit charges and Credit Card interest charges

- Late payment and collection charges

- Tax refunds from overseas purchases

- Balance Transfer

- Instalment plans, except where American Express determines otherwise

- Annual membership fees

- Amount billed for purchase of HighFlyer Points to top-up your points balance

- Purchase and top-up charges for EZ-Link cards using American Express Cards

- Charges at merchants or establishments that are excluded by American Express at its sole discretion and notified by American Express to you from time to time

Everything else is fair game, whether it’s charitable donations, education, hospitals, government bills, insurance premiums, utilities, or even GrabPay top-ups. This makes the AMEX HighFlyer Card an excellent option for earning miles on transactions that wouldn’t normally qualify.

What if AMEX isn’t accepted? A simple workaround is to:

- Use the AMEX HighFlyer Card to top-up a GrabPay account (earning 1.8 mpd in the process)

- Spend your GrabPay balance via the GrabPay Mastercard

Unfortunately, GrabPay no longer supports AXS payments ever since 16 January 2023. This rules out earning miles on things like condo MCST fees, income taxes, and certain insurance premiums or government transactions.

However, to the extent that Mastercard is accepted, you can use the AMEX HighFlyer Card + GrabPay Mastercard combination to earn miles on transactions that would normally not qualify:

- Buying travel insurance

- Making donations via Giving.sg or other charity portals that take cards

- Paying tuition fees or other education-related expenses

- Paying hospital or polyclinic bills

- Paying insurance premiums (credit cards are normally accepted for first year premiums, though it depends on the underwriter)

- Paying town council fees

- Paying utilities bills

What do I need to know about HighFlyer points?

| ❌ Expiry | ↔️ Pooling | ✈️ Transfer Fee |

| 3 years | N/A | None |

Expiry

HighFlyer points expire after 3 years on the last day of the equivalent month in which they were earned.

For example, all HighFlyer points earned from 1-31 July 2023 would expire at 2359 hours Singapore time on 31 July 2026.

Pooling

This is the only credit card which earns HighFlyer points, so pooling is not relevant.

Transfer Fees & Partners

HighFlyer points earned from the AMEX HighFlyer Card are batched and automatically transferred to your HighFlyer account once per month, on your statement closing date. No transfer fees apply.

HighFlyer points can be instantly converted to KrisFlyer miles at a 1:1 ratio, also with no transfer fees. However, some restrictions apply:

- Each HighFlyer account can only be linked to a maximum of five selected KrisFlyer accounts for the purpose of converting HighFlyer points to KrisFlyer miles

- Each HighFlyer account is only allowed to convert HighFlyer points to a maximum of 150,000 KrisFlyer miles per calendar year

- Each selected KrisFlyer account may receive a maximum of 30,000 KrisFlyer miles converted from HighFlyer points per calendar year, regardless of which HighFlyer accounts the points are converted from

Is the per account conversion cap of 30,000 miles a deal-breaker? I don’t think so. If your primary use case for this card is to earn miles on transactions that wouldn’t otherwise qualify, that’s still 30,000 extra miles per year.

While technically speaking, only employees of your company can be added as corporate travellers, I’ve read reports of people successfully adding spouses or family members to help them cash out a further 30,000 miles per individual (subject to the overall 150,000 miles cap).

What else can you do with HighFlyer Points?

In addition to KrisFlyer miles redemptions, HighFlyer Points can also be used for:

- Paying for Singapore Airlines tickets and add-ons at a rate of 1,050 HighFlyer Points= S$10

- Redeeming Scoot e-vouchers at a rate of 1,050 HighFlyer Points= S$10

- Redeeming lounge passes at a rate of 5,000 HighFlyer Points= 1 lounge pass

- Redeeming KrisFlyer Elite Gold status for a 12-month period for 150,000 HighFlyer Points

You can read the full details about each redemption option below.

Other card perks

Annual spending bonuses

AMEX HighFlyer Cardholders who spend at least S$500 on Singapore Airlines or Scoot transactions within their first membership year will receive a bonus of 5,000 HighFlyer points.

AMEX HighFlyer Cardholders who spend at least S$10,000 on Singapore Airlines or Scoot transactions within any membership year will receive a bonus of 15,000 HighFlyer points.

In other words, spending S$10,000 on Singapore Airlines or Scoot transactions would earn you:

- 20,000 bonus HighFlyer points in your first membership year

- 15,000 bonus HighFlyer points in your second and subsequent membership years

Accor Plus membership

One of the highlights of the AMEX HighFlyer Card is the free Accor Plus Explorer membership, which includes one complimentary hotel night each year.

This can be redeemed at hotels in Singapore and across Asia Pacific; I recently used my certificate for a free stay at the Sofitel Sydney Darling Harbour.

Accor Plus members also get access to the periodic Red Hot Rooms sale, which may be a good opportunity to book cheap staycation rates. I’ve seen the Fairmont Singapore going for as low as S$143 nett, and the Grand Mercure for as little as S$64 nett.

The other big draw of an Accor Plus membership are the dining discounts. The discount structure works like this:

- 25% off dining: 1 member only

- 50% off dining: 1 member and 1 guest

- 33% off dining: 1 member and 2 guests

- 25% off dining: 1 member and 3 guests

- 15% off drinks in Asia

Some examples of participating Accor Plus restaurants in Singapore include Prego, Mikuni and Asian Market Cafe at the Fairmont, SKAI, The Stamford Brasserie, CLOVE, at Swissotel and The Cliff and Kwee Zeen at the Sofitel Sentosa Resort.

In fact, should you enjoy the benefits of an Accor Plus membership, it’s still cheaper to pay the AMEX HighFlyer Card’s annual fee instead of buying an Accor Plus Explorer membership (S$418).

For those who have already received their AMEX HighFlyer Card, here’s how to go about activating your Accor Plus membership.

Lounge visits

AMEX HighFlyer Cardholders enjoy two complimentary lounge visits per membership year via Priority Pass. These visits can be used for the cardholder or his/her guests. Any visits beyond the complimentary entitlements will be billed at US$32 each.

Two free lounge visits is par the course for entry-level cards in this segment.

| Card | Lounge Access? |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend | ✔ (4 per year) |

AMEX HighFlyer Card AMEX HighFlyer Card | ✔ (2 per year) |

Citi PremierMiles Citi PremierMiles | ✔ (2 per year) |

DBS Altitude DBS Altitude | ✔ (2 per year, Visa version only) |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card | ✖ |

BOC Elite Miles BOC Elite Miles | ✖ |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit Card | ✖ |

OCBC 90°N Card OCBC 90°N Card | ✖ |

UOB PRVI Miles UOB PRVI Miles | ✖ |

KrisFlyer Elite Gold fast track

Cardholders who spend at least S$15,000 on Singaporeair.com purchases within the first 12 months of card approval will receive an automatic upgrade to KrisFlyer Elite Gold.

This benefit is only valid for the first year; subsequently, you’ll have to requalify by flying at least 50,000 elite miles in a 12-month membership period.

KrisFlyer Elite Gold confers additional benefits when flying on Singapore Airlines or Star Alliance carriers, such as:

- A 25% bonus on KrisFlyer miles

- Lounge access

- Priority check-in

- Priority boarding

- Priority luggage handling and additional 20kg allowance

For more details on KrisFlyer Elite Gold benefits, refer to the post below.

Summary Review: AMEX HighFlyer Card

| |||

| Apply |

Until recently, the AMEX HighFlyer Card was a complete no-brainer to get. Why wouldn’t you, with a first year fee waiver, complimentary Accor Plus membership, and the ability to earn free miles on income tax payments, MCST fees, insurance premiums or any other bill payable on AXS?

Now, it’s not quite as sweet- you’ll have to pay the first year’s fee, and the nerfing of GrabPay-AXS has reduced the scope to earn free miles on bill payments. That said, so long as this card awards miles for GrabPay top-ups, you can still earn free miles on any bill payable with a Mastercard (or AMEX), including commonly-excluded categories like donations, education expenses, hospital bills, certain insurance premiums, utilities and more.

It’s for that reason I believe this card is still a must-have, because you should never say no to free miles (and if nothing else, the annual fee gets you an Accor Plus membership at a discount to retail price).

| 🦁 MileLion Verdict | |

| ☑ Take It ☐ Take It Or Leave It ☐ Leave It |

FYI: If you’re a foreigner who runs their own company (which sponsors your EP/whatever in SG), you’ll need to be able to show two personal IRAS NOAs for approval.

That basically means you can only apply for this thing if you’ve spent two years in SG already.

This is a silly policy given it’s a corporate focused card to begin with. They’re not willing to accept bank statements, or form 21 from your company.

(As an aside, you can get 5.5 out of the 8 MPD for SIA spend by just signing up for SIA HighFlyer independently)

Hi

Just wonder the acra application requires any fees or annual fees?

Yes. And don’t forget filling requirements.

One should have a legit business then get the card…not purposely go to register a business just to get this card.

what makes you the gatekeeper? acra won’t say no to free $$ for nation building.

Actually there is a no annual fee option . But no bonus points will be awarded

But the points come at a cheap rate so no reason to not take

Can confirm if the following is factual ? My understanding from cso is different and I vaguely recall earning 8.5 on my 2020/2021 tickets

“HighFlyer points are not earned on award redemptions, so if you’re using the AMEX HighFlyer Card to pay for taxes and surcharges on award tickets, you’ll earn just 2.5 mpd.”

sorry for the noob question, but does the company or the individual get the credit bill? and the annual fee is paid by the company or individual?

in other words is this like a company card or is this a card for an individual who just need to be able to prove he is a director/major shareholder of a company?

Starting from Apr 4, they will be excluding grab top ups.

https://www.americanexpress.com/content/dam/amex/sg/benefits/SGexclusions_Mar2023.pdf

Can you retain your Highflyer account and CC if you dont renew your company’s registration on ACRA annually?

Just received an email yesterday saying “Starting 4 April 2023, changes will be made to the list of eligible purchases for the award of HighFlyer points. For the latest list of non‑eligible transactions, please visit go.amex/sgexclusions.”

New exclusion:

“Payments for the purpose of GrabPay top-ups”

Glad I managed to clock my miles before this coming nerf!

Does this still have miles for grabpay top ups?