UOB normally charges a fee of S$25 each time you convert your UNI$ into KrisFlyer miles (unless you’re a UOB Reserve, UOB Visa Infinite or UOB Privilege Banking cardholder, in which case it’s free).

However, there’s another option available for those who frequently convert their points. For a S$50 annual fee, UOB cardholders can get their UNI$ automatically converted on the last day of each calendar month. If this happens to be a weekend or public holiday, the auto conversion will take place the next working day.

This is called the “KrisFlyer Auto Conversion Programme”. As the name suggests, this program is only for KrisFlyer members; Asia Miles members will still have to do ad-hoc conversions at S$25 per pop.

Each conversion is in blocks of 5,000 miles (UNI$2,500), which is half of UOB’s regular conversion block. There must a minimum balance of 30,000 miles (UNI$15,000) maintained at all times in the principal cardmember’s account. In other words, if I have UNI$40,000 at the end of a month, UNI$25,000 will be converted.

| Your card will be temporarily charged with a $25 conversion fee which will be reversed within seven working days, so don’t be surprised to see it appear. |

Now, I’m a bit befuddled as to why UOB requires members to leave this “working capital” in their UNI$ balance. The cynic in me says it’s because the bank automatically deducts UNI$ to cover card annual fees, but those are typically UNI$4,800-6,000 each time so keeping UNI$15,000 on hand still seems excessive. Heck, that’s 30,000 miles, enough for 2 people to fly round-trip to Bali.

For what it’s worth, this is UOB’s explanation in the FAQ’s:

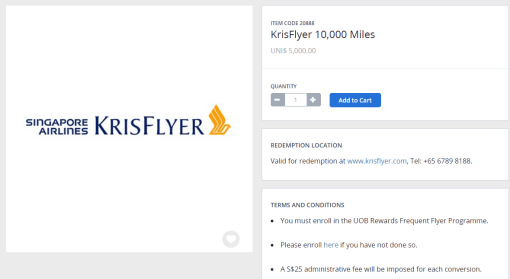

| Why must a minimum balance of UNI$15,000 be kept KrisFlyer auto conversion programme? This is to give card members the flexibility to convert the UNI$ to other items from UOB Rewards Catalogue. Card members can still choose to convert this UNI$15,000 to KrisFlyer miles by the one time miles redemption process through UOB Rewards Catalogue, subjected to S$25 conversion fee and must be in blocks of 10,000 miles |

Make of that what you will.

The full T&C of this scheme (together with multiple misspellings of “principal”, although to be fair, I keep mixing up “dessert” and “desert”) can be found at point 6 in this file.

Should you enroll for automatic conversions?

So long as you do more than two conversions in a year, you’ll be better off with the automatic conversion option. Do take note, however, that your UNI$ are valid for 2 years, and KrisFlyer miles are valid for 3 years. Electing to automatically convert UNI$ means your 3 year countdown starts immediately, and you lose out 2 years of validity on the UOB side.

That said, if you find value in automatic conversion, you’re probably the sort who is burning miles so often that a 3 year expiry period isn’t even an issue.

How does this compare to DBS’s auto conversion option?

| UOB | DBS | |

| Annual Programme Fee | S$50 | S$42.80 |

| Auto Conversion Frequency | Monthly | Quarterly |

| Auto Conversion Block | 5,000 miles | 1,000 miles |

| Ad-hoc redemptions | Available at S$25 | Free of charge |

| Minimum Holding Balance | 30,000 miles | None |

DBS launched an auto conversion programme of their own back in early 2018, so I figured it was relevant to compare it against UOB’s.

DBS only does their conversions every quarter, so you’ll have four automatic conversions a year, versus 12 with UOB. However, you’re still entitled to do ad-hoc redemptions through the DBS Rewards page for free if you’re enrolled in the auto conversion program, so the reduced frequency isn’t that big a deal.

DBS has smaller automatic conversion blocks of just 1,000 miles, and more importantly, doesn’t require the maintenance of a “working capital” balance in your DBS points account.

Conclusion

If you have no interest in Asia Miles, burn through your KrisFlyer miles at a rapid clip and are fairly confident that expiring miles won’t be an issue, then UOB’s automatic conversion makes sense for you, since you’ll have your miles ready at hand to jump on any unexpected redemption opportunities.

The annoying thing is that you’ll have a 30,000 block that you can’t touch without incurring a further S$25 fee (which would defeat the purpose of a flat annual fee)