We’re just one month away from the second anniversary of the Standard Chartered X Card, which raises what’s become an annual question for cardholders: keep or cancel?

Last year the issue was settled almost by default, as Standard Chartered offered an “exceptional” waiver of the annual fee. It was a nice gesture, but let’s be honest: they didn’t have much of a choice. Not waiving the fee would have meant a mass exodus of customers, since no one in the right mind was going to pay S$695.50 for a couple of lounge visits that couldn’t even be used.

In the year that followed, I was hoping Standard Chartered would use the time they’d bought to enhance the features of the X Card. Instead, it’s been mostly radio silence. If anything the X Card is weaker than before, thanks to the termination of the 50% dining discount at Fullerton hotels. Moreover, the bank has sent mixed messages by relaunching the Standard Chartered Visa Infinite, the product that the X Card supposedly replaced.

All this paints a hazy picture for the future of a card that launched with such a bang.

Standard Chartered X Card: Story so far

The Standard Chartered X Card officially launched on 25 July 2019 with a sensational 100,000 miles sign-up bonus. This was unprecedented in Singapore, and proved so popular it had to be pulled just six days after launch.

The replacement sign-up offer of 60,000 miles was still good, though obviously not as attractive as the original.

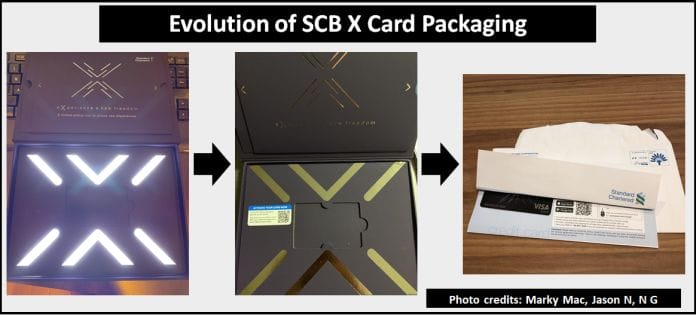

Even so, Standard Chartered had difficulty keeping up with demand. This was nowhere more apparent than the packaging. When it first launched, the X Card came in a beautiful box that lit up when opened. A few weeks later, and that became a regular box sans lights. A few weeks more, and just a regular envelope.

So overwhelming was the response that Standard Chartered eventually decided to temporarily suspend any new applications on 20 August 2019. There then followed a limbo period, and at one point the X Card had been closed for applications twice as long as it’d been open.

The moratorium came to an end on 16 October 2019 when the X Card relaunched in plastic form. Cardholders would get an IOU for a metal card, with the same 60,000 miles sign-up bonus.

That sign-up bonus ended on 31 December 2019, and while 2020 saw a couple of partner-specific offers with Qantas and EVA Air, it’s otherwise been quiet.

What will cardholders get for renewing?

Based on anecdotal reports from the X Card Telegram Group, cardholders who called in to cancel have been offered 50,000 rewards points (20,000 miles) as a “retention bonus.”

Let’s be clear: Paying S$695.50 for 20,000 miles works out to 3.48 cents per mile, a ridiculous sum to pay during regular times, much less now. There’s no way this should be a reason for anyone to hold on to their card.

In fact, Standard Chartered (and HSBC) cards are unique among the premium segment in not offering any miles with the annual fee from the second year onwards. I’ve never understood this, quite frankly, as their perks aren’t strong enough to warrant that kind of behavior.

| Card | Annual Fee | Welcome Gift | Second Year Onwards |

SCB X Card SCB X Card | S$695.50 | 30,000 miles | 20,000 miles* |

Citi Prestige Citi Prestige | S$535 | 25,000 miles | 25,000 miles |

HSBC Visa Infinite HSBC Visa Infinite | S$650 (S$488 for HSBC Premier) | 35,000 miles | N/A |

OCBC VOYAGE OCBC VOYAGE | S$488 | 15,000 miles | 15,000 miles |

SCB Visa Infinite SCB Visa Infinite | S$588.50 | 35,000 miles | 20,000 miles* |

UOB VI Metal Card UOB VI Metal Card | S$642 | 25,000 miles | 25,000 miles |

| *Not given automatically; must call up to appeal | |||

That said, even if the X Card awarded the same number of miles in the second year, it still wouldn’t be enough, 30,000 miles for S$695.50 works out to 2.32 cents per mile, well above the fair market value.

An optimist may say that renewing your X Card would allow you to participate in whatever promotions Standard Chartered has planned for the upcoming year. But I’m not very confident here either. While the X Card’s inaugural year saw some very attractive transfer promotions, most notably a 100% bonus to Accor Live Limitless, the past 12 months have been muted. I can only recall a transfer bonus for Qantas Frequent Flyer and Lufthansa Miles & More, neither of which were worth your time. In any case, I’m hardly going to renew my card based on something that might happen.

I feel like I’m scraping the bottom of the barrel already, since the only other argument I could see for keeping the X Card is to earn 4 mpd on foreign currency spend with the Rewards+. Then again, I think that logic is backwards- you get the Rewards+ if you’ve decided to keep the X Card, not vice versa.

Otherwise, Standard Chartered hasn’t added any new benefits to the X Card, nor launched any tax payment promotion to coincide with income tax season. I see little reason to believe anything will change in the upcoming year, and it’s hard to make any case for keeping it.

Should I cancel my card now?

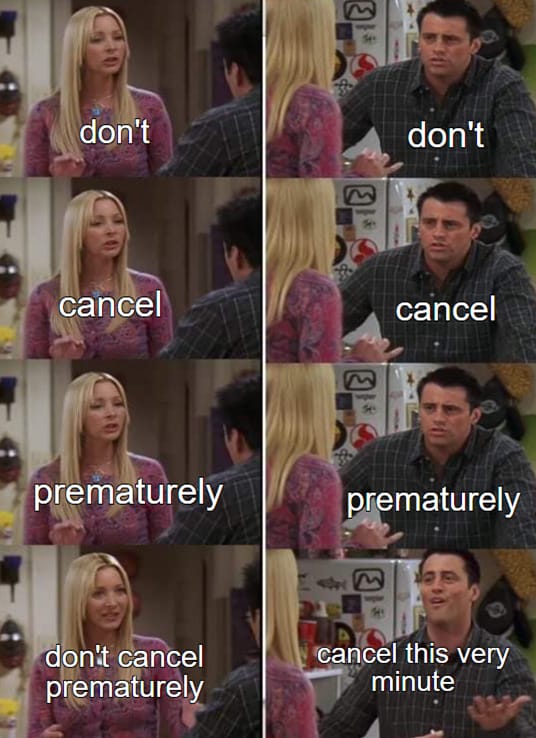

I’ve always said that it makes little sense to cancel a credit card ahead of the upcoming year’s annual fee, since you won’t get a partial refund on the current year anyway. Once the annual fee has been charged, you can always call up the bank to cancel, upon which the fee should be refunded too.

That advice remains unchanged. However, I understand that some have nonetheless decided to cancel their X Card ahead of schedule, in order to avoid the “administrative inconvenience” involved.

What they mean by this is that it’s possible to cancel a Standard Chartered credit card via the SCB app/ibanking portal, provided there’s no outstanding balance. If your annual fee has been posted, that counts as a balance and you’ll need to call up the bank to get the cancellation processed manually.

It’s not that big a hassle for me to make a phone call, although I’ve read a couple of stories that CSOs have been trained to punt the issue to an RM, who will arrange a callback to convince you to stay. This might draw out the cancellation process somewhat, although I wouldn’t consider it reason enough to cancel early.

Before you cancel your X Card, be sure to redeem all your rewards points (no, they haven’t removed KrisFlyer, stop asking). If you happen to also hold a Standard Chartered Visa Infinite, you can ask the bank to transfer your X Card points over to the Visa Infinite account before cancelling (at least based on a couple of data points I’ve seen- YMMV). However, you will not be able to do this if you hold any other Standard Chartered credit cards (since points earned on the X Card and Visa Infinite enjoy a special rate when transferred to KrisFlyer).

I’ve written a guide on the most efficient way of cashing out your X Card points, which you can find here.

Conclusion

Barring a last-minute fee waiver or some sort of Hail Mary, I can’t see myself keeping the X Card beyond July. I’m still puzzled as to what exactly Standard Chartered was trying to do with this product- yes, it’s the easiest metal card to get with an income requirement of just S$80,000, but what can you actually do with it?

Affluent millennials want to know.

Anyone see a reason to hold on to the X Card?

Aaron, understand you’re a SCB Priority Banking client. Would you use the PB VI (blue card, not brown) as a way to continue earning 4mpd on the Rewards+ card?

Now there’s an idea…

but having looked at it a bit closer, maybe not. I was under the impression the AF would be waived for priority banking customers, but you’re still on the hook for S$321. unless there’s some unofficial waiver i’m unaware of, I wouldn’t be keen to pay.

Maybe contact your RM and ask

Found out that actually Priority Banking members do get fee waivers for the PBVI. It’s hidden down there in the FAQs, all the way at the last question.

https://www.sc.com/sg/credit-cards/priority-visa-infinite-card/

If you ever tried calling SCB customer service you would understand why people are trying to avoid it like the plague.

SCB customer service is terrible!

I’ve dealt with them mainly via online chat. can’t be as bad as Citibank…

To be fair to SCB, I’ve had good service so far whenever I’ve had to call about my SC VI (brown) card – which is about once a year to get my renewal miles. No hassle so far and usually done in < 5 minutes, without much waiting for a CSO either beyond selecting the numbered phone options. But despite some personalized offers, I’ve resisted rejoining the Priority Banking since I closed my account 10 years ago. The service at their branches was substandard for me and being told that I can’t have a thumbprint account was also hard to… Read more »

Can points from the x card be transferred to SCVI? I’ve contacted Stanchart and have been informed it’s not possible…

I read a few successful reports in the Tele chat…ymmv

Perhaps SCB wanted to see if the semi-affluent market would be willing to pay for a low-entry metal card just for the flex.

If I see annual fee charged, I’ll just cancel. Have not used the card after 1st year and points all redeemed…..

There is an opportunity cost to keep the card. I cancelled the card early so that I can become a “new” to bank customer earlier and wait for the next promotion.

yup, that’s worth considering too, especially since singsaver has such great offers for new to bank SCB cardholders now

hope you’ll do one for Amex Plat Charge card too!

https://milelion.com/2020/09/17/american-express-platinum-charge-2020-year-in-review/

There was just one in September last year, I’m guessing if there is going to be another it will be the year’s review in September again ^_^

my renewal cycle comes towards q4, so i’ll take another look then

Just cancelled mine. Joke of a card.

Pumped and dumped.

Redeem your miles and cancel the card BEFORE your annual fee is posted. Tone deaf customer service. Got 3 different CSOs basically parroting the standard lines in response to annual fee waiver if I cancel the card. No attempt to try to sweeten the deal whatsoever.

Apparently you can’t just call them to cancel your card. I was told by the CS this can only be done using online banking, if you are someone like me never use their online banking you will have to download their app before you can use the online banking, how convenient!

Have you heard of a time when the annual fee for the x card is charged and the person immediately called in to waive and cancel but standard chartered refused to saying that it is strictly non-waivable?

i have heard such stories. you should escalate. there is no way they can charge you an annual fee in respect of the UPCOMING year, when you want to cancel!