For the past couple of months, CardUp has been offering Visa cardholders a special 1.75% admin fee when paying their YA2023 income tax bill with the promo code MLTAX23.

Now, it’s added an offer for Mastercard cardholders too, albeit slightly less generous.

From now till 31 August 2023, Mastercard cardholders can enjoy a 1.99% admin fee when paying income tax with the promo code MCTAX23. This is valid for a one-off payment, and can be used a maximum of once per customer.

| 💳 CardUp Income Tax Payment Promos | ||

| MLTAX23 | MCTAX23 | |

| Applicable To | Visa | Mastercard |

| Admin Fee | 1.75% | 1.99% |

| Min. Spend | N/A | N/A |

| Cap | N/A | N/A |

| Schedule By | 31 Aug 23 | 31 Aug 23 |

| Due Date By | 31 Mar 24 | 8 Sep 23 |

| Payment Type | One-off or recurring | One-off only |

Pay income tax via Mastercard with a 1.99% fee

Here’s the key details of CardUp’s 1.99% income tax payment promotion for Mastercard customers:

- Use code MCTAX23

- Payments must be scheduled by 31 August 2023, with a due date on or before 8 September 2023. Payments must be scheduled at least three business days in advance of the due date to allow for processing time

- Promo code can be used once per customer, for a one-off payment

- No maximum or minimum spend

- Valid for Singapore-issued Mastercard cards only

This code is valid for both new and existing CardUp users, but if you’re a new user, be sure to check out the offer below.

| ❓ First-time user? |

If this is your first time using CardUp, use the code MILELION to save S$30 off your first transaction with no minimum spend required. This allows you to earn free miles on a payment of up to S$1,154 (based on CardUp’s regular admin fee of 2.6%). You can subsequently use the MLTAX23/MCTAX23 code to pay the rest of your balance, since these codes are valid for both new and existing customers. |

Terms & Conditions

The T&Cs of this offer can be found here.

What’s the cost per mile?

Here’s the cost per mile for various Mastercards in Singapore, given their earn rates and a 1.99% admin fee.

| Card | Earn Rate | Cost Per Mile (1.99 % fee) |

UOB PRVI Miles MC UOB PRVI Miles MC | 1.4 | 1.39 |

Citi Prestige^ Citi Prestige^ | 1.3 | 1.50 |

OCBC 90ºN MC* OCBC 90ºN MC* | 1.3 | 1.50 |

Citi PremierMiles MC^ Citi PremierMiles MC^ | 1.2 | 1.63 |

KrisFlyer UOB KrisFlyer UOB | 1.2 | 1.63 |

BOC Elite Miles BOC Elite Miles | 1.0 | 1.95 |

| ^Citi Prestige and Citi PremierMiles MC customers should consider the ongoing Citi PayAll offer of 2.2 mpd with a 2.2% admin fee (1 cent per mile), valid with a min. spend of S$8K *OCBC 90ºN MC customers can also use the code OCBC90N15 for 1.5% fee, valid for first-time payments only. | ||

Remember: both the tax payment amount and the CardUp fee are eligible to earn miles.

For example, someone who pays a S$1,000 tax bill via CardUp would pay S$1019.90 after fees. If he uses a 1.4 mpd card, he will earn 1,428 miles (ignoring rounding), for which he has paid a fee of S$19.90. The cost per mile is therefore 1.39 cents each.

While this isn’t the cheapest possible way of paying income tax (see below for Visa options), it’s still a good price in and of itself. Assuming your tax bill is large enough, you could be buying a Business Class ticket to Japan or South Korea for just over S$1,446 plus taxes (Business Saver @ 104,000 miles @ 1.39 cents each).

Pay income tax via Visa with a 1.75% fee

As a reminder, Visa cardholders can pay income tax via CardUp with a 1.75% fee when they do the following:

- Use code MLTAX23

- Payments must be scheduled by 31 August 2023, with a due date on or before 31 March 2024. Payments must be scheduled at least three business days in advance of the due date to allow for processing time

- Promo code can be used once per customer, either for a one-off payment or entire series of recurring payments

- No maximum or minimum spend

- Valid for Singapore-issued Visa cards only

This code is valid for both new and existing CardUp users.

More importantly, it can be used for both one-off and a recurring series of payments, allowing you to take full advantage of IRAS’s interest-free instalments.

Terms & Conditions

The T&Cs of this offer can be found here.

What’s the cost per mile?

Here’s the cost per mile for various Visa cards in Singapore, given their earn rates and a 1.75% admin fee.

| Card | Earn Rate | Cost Per Mile (1.75% fee) |

DBS Insignia DBS Insignia | 1.6 | 1.07 |

UOB Reserve UOB Reserve | 1.6 | 1.07 |

OCBC VOYAGE OCBC VOYAGE(Premier, PPC, BOS) | 1.6 | 1.07 |

Citi ULTIMA Citi ULTIMA | 1.6 | 1.07 |

SCB VI SCB VI | 1.4* | 1.23 |

DBS Vantage DBS Vantage | 1.5 | 1.15 |

UOB PRVI Miles Visa UOB PRVI Miles Visa | 1.4 | 1.23 |

UOB VI Metal UOB VI Metal | 1.4 | 1.23 |

OCBC VOYAGE* OCBC VOYAGE* | 1.3 | 1.32 |

OCBC 90°N Visa OCBC 90°N Visa | 1.3 | 1.32 |

OCBC Premier VI* OCBC Premier VI* | 1.28 | 1.34 |

SCB X Card SCB X Card(aka SCB Journey) | 1.2 | 1.43 |

DBS Altitude Visa DBS Altitude Visa | 1.2 | 1.43 |

| *OCBC VOYAGE and Premier Visa Infinite customers can also use the code OCBC15 for a 1.5% fee, valid for first-time payments only | ||

The cost per mile for Visa cards starts from as little as 1.07 cents, thanks to their higher earn rates and the lower admin fee.

Using our same illustration of a Business Class ticket to Japan/South Korea, the cost would now be S$1,113 plus taxes (Business Saver @ 104,000 miles @ 1.07 cents each).

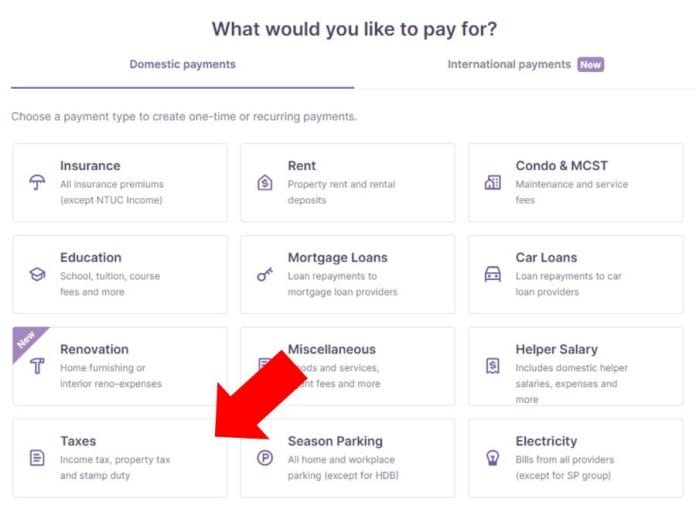

How to set up income tax payments

To schedule an income tax payment, login to your CardUp account and click on Create Payment > Taxes > IRAS-Income Tax

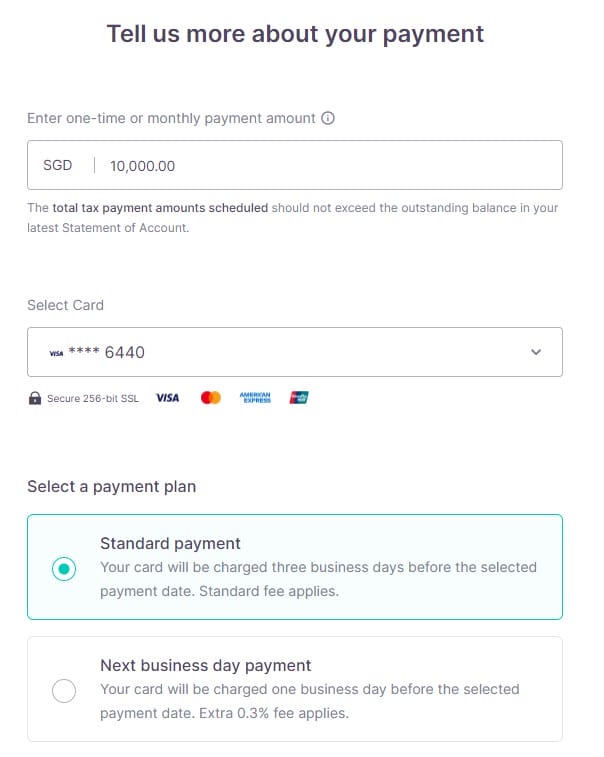

On the next screen, you’ll be prompted to enter the payment amount, choose a card, and a payment plan (the code is only valid for Standard payments).

Your payment reference number will be automatically filled based on the NRIC number registered to your CardUp account (this also means you can’t use CardUp to pay someone else’s taxes).

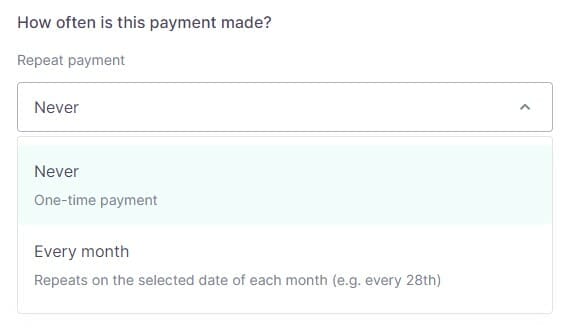

You’ll also be prompted to choose whether you want this to be a one-time payment, or recurring payment.

One-time payment

Under this option, you can pay any amount up to the total tax due on your NOA.

In other words, if your tax bill is S$10,000, you can pay any amount up to S$10,000.

Recurring payment

Under this option, you can use CardUp to pay your monthly instalment under a GIRO plan with IRAS.

This can be set up via the following methods:

- Instant

- myTax portal (DBS/POSB and OCBC customers)

- Internet banking (DBS/POSB, OCBC and UOB customers)

- AXS stations (DBS/POSB customers)

- 3 weeks processing

- GIRO application form (all bank customers)

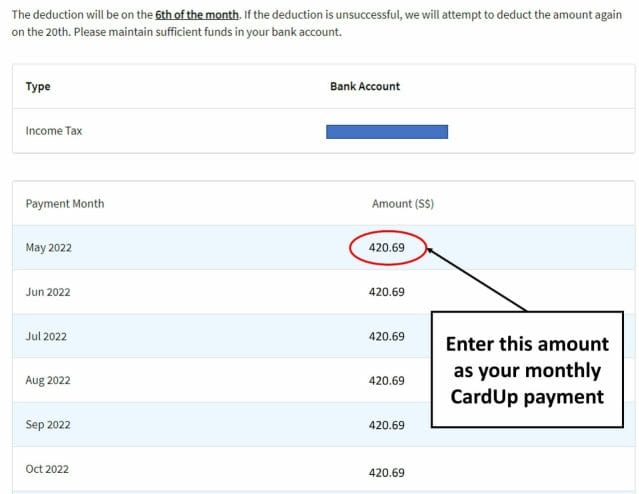

Once your GIRO arrangement has been approved, you can view the monthly instalment by logging to myTax Portal, selecting Account > View Payment Plan > View Plan.

This is the figure you need to enter as the payment amount in the CardUp portal.

You’ll also need to select the date of the first and last monthly payment. Do note that first and last few dates of every month will be blocked off. That’s because IRAS does their deductions on the 6th of every month, and CardUp payments need to arrive in advance of that to avoid double deductions.

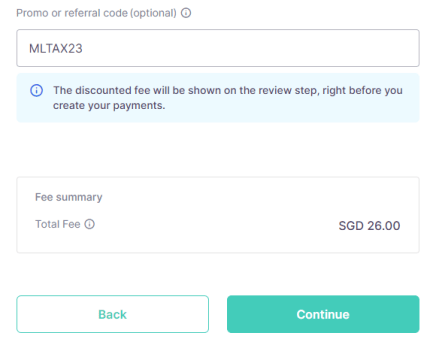

Regardless of whether you choose one-time or recurring, don’t forget to enter the relevant promo code. Don’t worry that the total fee doesn’t reflect the discount yet- that will appear on the final screen.

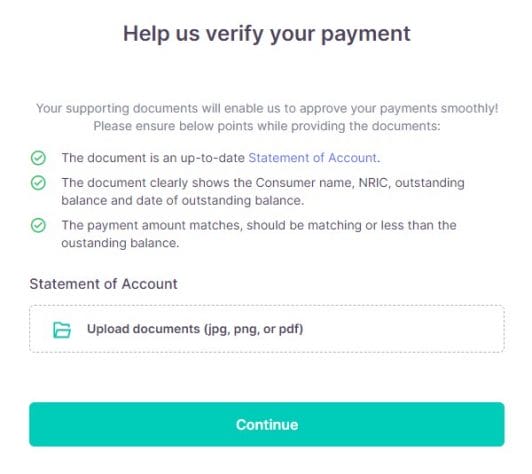

On the next screen, you’ll be prompted to upload a copy of your NOA for verification. This is to ensure you aren’t using CardUp to overpay your tax bill, which is a big no-no from an IRAS point of view.

Finally, you’ll be able to review the payment schedule before confirming it.

If you chose a one-time payment, you’ll see something like this:

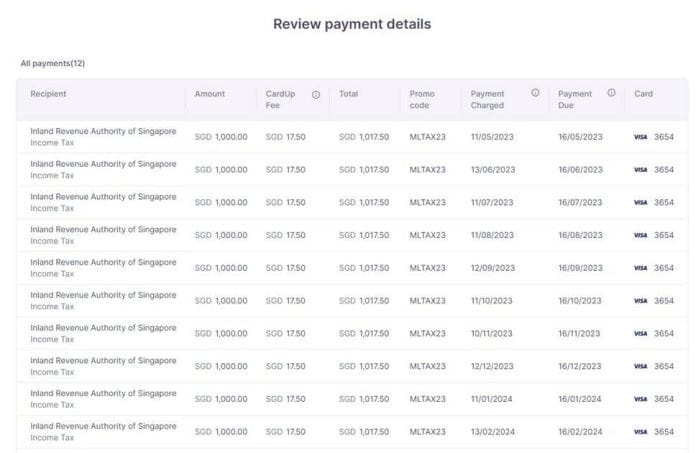

If you chose a recurring payment, you’ll see something like this (remember: only the MLTAX23 code can be used for recurring payments)

Income tax guide 2023

I’ve updated The MileLion’s Income Tax Guide 2023 with this latest offer.

This post provides a detailed walkthrough of the various options for paying income tax with a credit card, as well as all the ongoing promotions for income tax season.

Conclusion

CardUp has launched a 1.99% offer for Mastercard customers who make a one-time IRAS income tax payment with the code MCTAX23.

If you have a Visa card, don’t forget you can use the code MLTAX23 to pay income taxes with a 1.75% fee, regardless of whether it’s a one-time or recurring payment series.

Still, it’s hard to beat Citi PayAll’s offer of 2.2 mpd with a 2.2% admin fee (1 cent per mile), although you will need a minimum spend of S$8,000 to trigger this rate.