Here’s the Milelion’s review of the BOC Elite Miles Card, which believe it or not, was undoubtedly the best miles card in the Singapore when it launched in 2018.

Fast forward two years, and oh how times have changed.

| 💳 tl;dr: ★1/2 | |

| You either die a hero, or you live long enough to see your value proposition get nuked. Once upon a time, customers put up with the BOC Elite Miles Card’s shenanigans for some jaw-dropping earn rates. With those gone, what’s the point? | |

| The good | The bad |

|

|

| This BOC Elite Miles review forms part of my collection of credit card reviews. I’m constantly adding new ones, and you can browse the entire collection here. |

Overview: BOC Elite Miles World Mastercard

Let’s start this review by looking at the key features of the BOC Elite Miles Card.

Apply Here Apply Here | |||

| Income Req. | S$30,000 p.a | Points Validity | 12-24 months |

| Annual Fee | S$203 (First Year Free) | Min. Transfer | 27,000 points (6,000 miles) |

| Miles with Annual Fee | None | Transfer Partners |

|

| FCY Fee | 3% | Transfer Fee | S$30 |

| Local Earn | 1.0 mpd | Points Pool? | No |

| FCY Earn | 2.0 mpd | Lounge Access? | No |

| Special Earn | None | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

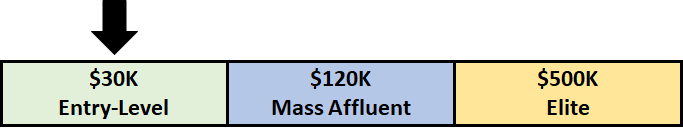

How much must I earn to qualify for a BOC Elite Miles Card?

The BOC Elite Miles Card is an entry-level offering with a S$30,000 income requirement, the MAS-mandated minimum.

To my knowledge, BOC does not offer the option of a secured credit card in Singapore.

How much is the BOC Elite Miles Card’s annual fee?

| Principal Card | Supp. Card | |

| First Year | Free | Free |

| Subsequent | S$203.30 | S$101.65 |

The BOC Elite Miles Card has an annual fee of S$203.30 for the principal cardholder, and S$101.65 per supplementary card. This is waived for the first year.

There is no automatic fee waiver in the second year, but as with all cards, you’re welcome to appeal for one. Be careful though- the last time round, some cardholders were told that their fee waiver had been approved, only for BOC to deduct 95,000 points (31,667 miles at old conversion rates) from their balance!

I shouldn’t have to spell this out, but when customers ask for a fee waiver, they typically don’t mean “can you deduct my points instead”. It’s just plain disingenuous, and ironically, the value of the miles lost would be much more than the annual fee.

There are no miles awarded for paying the BOC Elite Miles Card’s annual fee.

What sign-up bonus or gifts are available?

When the BOC Elite Miles Card debuted, cardholders could claim this charming “20-inch vintage-style luggage bag.”

Vintage indeed, because nothing screams “old world romance of travel” like a sturdy, machine-molded plastic case, forged in the bowels of Tianjin Industrial City.

Unfortunately, that gift is no longer available. There is currently no sign-up bonus or gift for the BOC Elite Miles Card.

How many miles do I earn?

| 🇸🇬 SGD Spending | 🌎 FCY Spending | ➕ Bonus Spending |

| 1.0 mpd | 2.0 mpd | None |

SGD/FCY Spending

The decline of the BOC Elite Miles Card’s earn rates could be an epic Greek tragedy in itself.

When the card first launched, it offered an unbelievable 2/5 mpd on local/FCY spending, without any cap. That was a limited-time promotion, but even the regular earn rates of 1.5/3 mpd on local/FCY spending were very competitive.

Then one fine day, BOC decided to nerf the earn rate to a mere 1 mpd on local spending (4.5 BOC Points/S$1), and 2 mpd on FCY spending (9 BOC Points/S$1), and here we are. In the space of less than two years, the BOC Elite Miles Card has gone from hero to subzero.

| Local MPD | FCY MPD | |

UOB PRVI UOB PRVI | 1.4 | 2.4 |

OCBC 90N OCBC 90N | 1.2 | 2.1 |

Citi PremierMiles Citi PremierMiles | 1.2 | 2.0 |

DBS Altitude DBS Altitude | 1.2 | 2.0 |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card | 1.1 | 2.0* |

BOC Elite Miles BOC Elite Miles | 1.0 | 2.0 |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit Card | 1.2 | 1.2 |

| *June and Dec only, otherwise 1.1 mpd | ||

All foreign currency transactions are subject to a 3% fee, so using your BOC Elite Miles Card overseas represents buying miles at 1.5 cents each.

Be advised that BOC has followed the cue of UOB in defining overseas spending as “transactions made at merchants with payment gateway outside of Singapore”. It’s a frustrating restriction to deal with, particularly because the customer has no way of knowing where a payment gateway is located.

For example, if you’re shopping on an online website which bills you US$100 (~S$140), but processes the payment within Singapore (Hotels.com is an example), you’ll earn miles at the local earning rate of 1.0 mpd.

When are BOC Points credited?

BOC Points are credited when your transaction posts, which generally takes 1-3 working days.

How are BOC Points calculated?

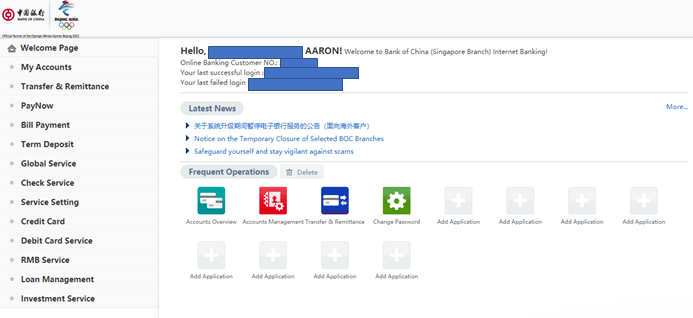

For all its flaws, at least the BOC Elite Miles Card has the most straightforward points calculation- simply multiply your transaction value by 4.5 (local) or 9 (FCY). The absence of rounding means you earn points right down to the very last cent. Heck, you even earn fractional BOC points, which are shown in your internet banking.

![]()

Here’s how BOC Points on your BOC Elite Miles Card are calculated:

| Local Spend | Multiply transaction by 4.5 |

| FCY Spend | Multiply transaction by 9.0 |

This means the minimum spend required to earn miles is S$0.01.

If you’re an excel geek, here’s the formulas you need to calculate points:

| Local Spend | =X * 4.5 |

| FCY Spend | =X* 9 |

| Where X= Amount Spent | |

For the full list of formulas that banks use to calculate credit card points, do refer to these articles:

What transactions aren’t eligible for BOC Points?

The following transactions are ineligible for BOC Points, as per the T&C

- Educational institutions (MCC: 8211, 8220, 8241, 8244, 8249, 8299);

- Hospitals (MCC: 8062)

- Insurance (MCC: 5960, 6300, 6399)

- Financial Institutions (MCC: 6010-12, 6050-51, 6211)

- Real Estate Agents and Managers (MCC: 6513)

- Gambling (MCC: 7995)

- Government Institutions (MCC: 9211, 9222, 9223, 9311, 9399, 9402, 9405)

- Money Transfers (MCC: 4829)

- Utilities (MCC: 4900)

- Charitable Donations (MCC: 8398, 8661)

- Prepaid accounts (MCC: 6540)

- AXS/SAM payments

The T&Cs also specifically note that neither RentHero nor ipaymy transactions will earn points. CardUp was originally on the exclusion list too, but was later removed.

What do I need to know about BOC Points?

BOC Points have an unusual expiry structure. Depending on when they’re earned, they can expire anywhere between 12-24 months.

| Earned | Expiry |

| 1 Jul 2018- 30 Jun 2019 | 30 Jun 2020 |

| 1 Jul 2019- 30 Jun 2020 | 30 Jun 2021 |

| 1 Jul 2020-30 Jun 2021 | 30 Jun 2022 |

BOC Points don’t pool across cards, but in any case, BOC only has one points-earning card of note.

There’s only two transfers partners available- Singapore Airlines and Cathay Pacific, both of which adopt the same 4.5 points : 1 mile ratio. However, the minimum transfer block for Cathay Pacific is smaller at 27,000 points.

| Frequent Flyer Program | Conversion Ratio (BOC Points: Miles) |

| 45,000: 10,000 | |

| 27,000: 6,000 |

Transfers cost S$30 per program, but here’s where another BOC shenanigan strikes: you can only transfer a maximum of 10 blocks at one go, either:

- 100,000 KrisFlyer miles (450,000 BOC points), or

- 60,000 Asia Miles (270,000 BOC points)

Why? Because they said so. There’s absolutely no technical reason for this; it’s a pure money-grab. I can tell you right now that 60,000 miles isn’t a lot, especially if you’re redeeming long-haul premium cabin travel for more than one person.

There is no other bank in Singapore that limits the number of points you can redeem at one go, so that’s another black mark.

All BOC points transfers must be done via this manual form; there’s no online rewards portal.

Other card perks

BOC SmartSaver integration

Here’s the sole saving grace: Spending on the BOC Elite Miles Card counts towards bonus interest on the BOC SmartSaver account. Cardholders can earn up to 1.6% p.a bonus interest through their spending.

| Monthly Spend | Bonus Interest |

| S$1,500 and above | 1.6% |

| S$500 to S$1,499.99 | 0.8% |

This, when added to the 0.4% base interest, 1.2% salary crediting and 0.35% bill payment bonuses, sums up to 3.55% p.a (capped at the first S$60,000)- quite extraordinary in our current low interest rate environment.

Does this interest make the BOC Elite Miles Card worth it? Suppose you spent S$500 per month in local currency and kept S$60,000 in the account:

- You’d earn an additional S$40 of interest per month

- However, you’d also lose out on 0.4 miles per S$1 spent (assume your alternative is a UOB PRVI Miles Card earning 1.4 mpd), or 200 miles in total

- 200 miles is worth perhaps S$4, so yes, you’re mathematically better off

Likewise, if you spent S$1,500 per month instead:

- You’d earn an additional S$80 of interest per month

- However, you’d also lose out on 0.4 miles per S$1 spent (assume your alternative is a UOB PRVI Miles Card earning 1.4 mpd), or 600 miles in total

- 600 miles is worth perhaps S$12, so again, you’re mathematically better off

The opportunity cost would obviously be higher if your alternative was a 4 mpd card, but it does appear to be a possible use case for BOC SmartSaver account holders, assuming BOC maintains these interest rates.

Then again, you need to factor in the drama that comes with the BOC Elite Miles Card…

Shenanigans

I am convinced by now that shenanigans are a feature of the BOC Elite Miles Card, not a bug.

We’ve already talked about the arbitrary cap of 10 points blocks in a single transaction and the unexpected points deductions for annual fee waivers, but there’s much more than that.

Processing times with BOC are painfully slow. When the card first launched, it took up to 3-4 months to process applications. Far from just teething problems, these delays continued long after- when my wife lost her card in July 2019, it took 36 working days to replace.

Then there’s the antiquated IT setup. Let’s leave aside the fact that the BOC web setup looks like something from the early 2000s, complete with SimSun-esque fonts and menus that were obviously machine-translated. To even access ibanking, you need to head down to a physical BOC branch to set it up. Then, when you get your BOC credit card, you need to go down again to link it to your account.

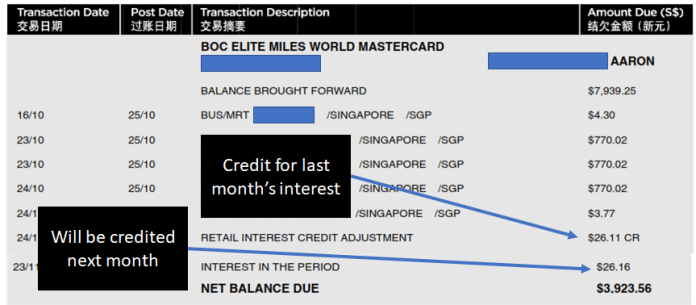

Started using your card? Great. Now beware of mysterious interest charges. Suppose you make two purchases of S$50 and S$100, and receive a refund of S$30 from a previous transaction. All-in-all, you owe the bank S$120, which is duly deducted through the GIRO arrangement you set up. Next month, however, you see interest on your account. When you call up the bank, you’re told you underpaid your balance by S$30!

What?

Yes, that’s not bizzaro world, that’s the reality of the BOC payment system, which does not see refunds as a contra to the amount due. In August 2019, I stumbled upon this practice that had presumably been going on for a while already. It was only after calling in that BOC refunded the excess interest- one wonders what would have happened if I didn’t call.

What’s crazy is that BOC hasn’t actually fixed the problem. Their SOP now is to still charge interest, but refund automatically it the following month.

One can only hope their systems aren’t reporting this to CBS as an incomplete payment…

Oh, and those points you earned? They may be worth a lot less tomorrow. BOC recently took the unprecedented step of devaluing its points transfer rate.

Now, banks can and do change earn rates for cards. The OCBC VOYAGE, for instance, changed its earn rates from 1.2/2.3 mpd to 1.3/2.2 mpd on 1 June. But those changes affect your future spending. Devaluing the points transfer rate has implications for spending you already made.

Previously, BOC used the following conversion rates:

- 30,000 BOC points: 10,000 KrisFlyer miles

- 18,000 BOC points: 6,000 Asia Miles

Those rates have now become:

- 45,000 BOC points: 10,000 KrisFlyer miles

- 27,000 BOC points: 6,000 Asia Miles

BOC did give a month’s notice, but even if you cashed out as much as possible, there’d almost certainly be orphan points left behind, which would be worth less under the new rates.

It’s scary that I’m barely scratching the surface of all the shenanigans that BOC Elite Miles Card members have encountered. I could talk about the points clawbacks, the fact you have to fill, scan, and email a form to transfer miles, or how the card didn’t get added to the BOC website for more than a year, but I’m pretty sure posts over 100,000 words don’t do well for SEO.

Let’s just say this card isn’t for the faint of heart.

Summary Review: BOC Elite Miles Card

You either die a hero, or you live long enough to see your value proposition get nuked.

That’s the story of the BOC Elite Miles Card, which at launch offered showstopping earn rates that were simply unprecedented. Unfortunately, what was also unprecedented was the dramatic fall from grace that’s brought us to this point.

Kafkaesque customer service and an archaic IT setup could be winked at so long as the earn rates were good. But take those away, and what appeal is left? Unless you’re a BOC SmartSaver customer looking to grind out an additional $40-80 of interest per month, there’s absolutely no reason you should get this card. And if you already hold it, you should be looking for an exit strategy.

So that’s my review of the BOC Elite Miles Card. What do you think?

| Overall Score | |

| ★1/2 | |

| Ratings Guide | |

| 5 Stars ★★★★★ | An essential card for miles chasers, with few viable alternatives |

| 4 Stars ★★★★ | A very good card, although other equally good alternatives may exist |

| 3 Stars ★★★ | A decent card to round out your collection, but not absolutely essential |

| 2 Stars ★★ | Very limited use cases, and outperformed by most other cards |

| 1 Star ★ | Paperweight. Use for picking teeth or ninja stars |

I am surprised you even marked 1.5 for this trash.

I cash out all my points and cancelling it now~

just by seeing it now makes me sick~

More like 0.5 stars. But I have to give credit to the CSO who noted that after transferring the maximum points to KF, I still had enough points for a FairPrice voucher. She converted the balance points for me and I duly received the voucher. But everything else about BOC sucks big time. Not worth the energy.

1 star is the lowest rating on the scale, actually…but maybe this card warrants a new scale 🙂

I like the Harvey Dent reference thrown in

Under the Shenanigans section, you forgot to add that their transaction SMS alerts are arbitrarily set at $100 to trigger, this threshold can’t be reduced, because BOC is too cheapskate to pay for more SMS alerts triggered by lower amounts.

I am dumping both the card and SmartSaver account. What is a good alternative to credit my salary?

DBS Multiplier

True. There is alternative and no need to keep BOC account or card anymore.

When this card was launched, BOC has the best cashback card (Family Card) and general spending card (Elite Miles). Then BOC changed T&C three times a year for Family card making me cancel it and now the same thing happens to Elite Miles…0 star for BOC