The Citi PremierMiles Card is one of the oldest miles cards in Singapore, and the best connected in terms of transfer partners.

But if you only have space in your wallet for one general spending card, is this the right one?

| |

| Citi PremierMiles Card | |

| ★★★★ | |

| It may not be the highest-earning general spending card, but transfer partner variety, lounge access, and the opportunity to buy cheap miles are compelling reasons to hold a Citi PremierMiles Card. | |

| The good | The bad |

|

|

| Full List of Credit Card Reviews | |

Overview: Citi PremierMiles Card

Let’s start this review by looking at the key features of the Citi PremierMiles Card.

Apply Here Apply Here | |||

| Income Req. | S$30,000 p.a. | Points Validity | No Expiry |

| Annual Fee | S$192.60 (First Year Free) | Min. Transfer | 10,000 Citi Miles (10,000 miles) |

| Miles with Annual Fee | 10,000 | Transfer Partners |

|

| FCY Fee | 3.25% | Transfer Fee | S$26.75 |

| Local Earn | 1.2 mpd | Points Pool? | No |

| FCY Earn | 2.0 mpd | Lounge Access? | Yes: 2x Priority Pass |

| Special Earn | 7 mpd on Agoda 10 mpd on Kaligo | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

While the Citi PremierMiles Card was previously issued on both the Visa and Mastercard network, all new cards are issued on the Mastercard network only. Existing Visa cards can continue to be used until expiry.

In any case, there’s very little difference between the two cards. We’ll be referring to the Mastercard version in this review, but almost everything said here applies to the Visa as well.

How much must I earn to qualify for a Citi PremierMiles Card?

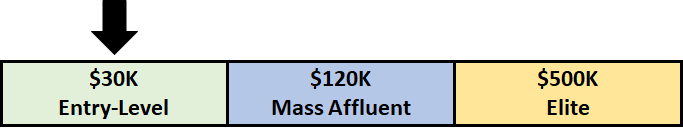

Upon launching in 2007, the Citi PremierMiles Card was positioned closer to the mass affluent end of the spectrum with an S$80,000 income requirement. Cardholders even received an invitation to join Citigold for a year with a reduced AUM requirement.

Those days are long gone, and today the Citi PremierMiles Card has been repositioned as an entry-level credit card with a S$30,000 income requirement, the MAS-mandated minimum.

If you don’t meet the income requirement, it may be possible to place a S$10,000 fixed deposit with Citibank and get a secured version of the card, with a credit limit of roughly 80-90% of the fixed deposit amount. Give Citibank a call if you’d like to explore this option.

How much is the Citi PremierMiles Card’s annual fee?

| Principal Card | Supp. Card | |

| First Year | Free | Free |

| Subsequent | S$192.60 | Free |

The Citi PremierMiles Card has an annual fee of S$192.60 for the principal cardholder, and no fee for supplementary cards. The first year’s fee is waived for the principal cardholder, and there is a perpetual waiver for all supplementary cards.

Paying the annual fee gets you 10,000 miles in return, which means buying miles at ~1.93 cents each. Depending on how much you value a mile, the card could potentially pay for itself. That said, it’s certainly possible to buy miles at a lower threshold, as we’ll see below.

How many miles do I earn?

| 🇸🇬 SGD Spending | 🌎 FCY Spending | ➕ Bonus Spending |

| 1.2 mpd | 2.0 mpd | 7 mpd on Agoda 10 mpd on Kaligo |

SGD/FCY Spending

Citi PremierMiles Card members earn 1.2 Citi Miles for every S$1 spent in Singapore Dollars, and 2 Citi Miles for every S$1 spent in foreign currency (FCY).

1 Citi Mile is worth 1 airline mile, so that’s an equivalent earn rate of 1.2 mpd for local spending, and 2.0 mpd for FCY spending.

Those aren’t the highest rates in the market, but they’re fairly competitive compared to other general spending cards.

| Cards | Local MPD | FCY MPD |

UOB PRVI Miles UOB PRVI Miles | 1.4 | 2.4 |

OCBC 90N Mastercard OCBC 90N Mastercard | 1.2 | 2.1 |

Citi PremierMiles Citi PremierMiles | 1.2 | 2.0 |

DBS Altitude DBS Altitude | 1.2 | 2.0 |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend | 1.2 | 2.0* |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card | 1.1 | 2.0* |

BOC Elite Miles BOC Elite Miles | 1.0 | 2.0 |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit Card | 1.2 | 1.2 |

| *June and Dec only, otherwise 1.1 mpd | ||

All foreign currency transactions are subject to a 3.25% fee, so using your Citi PremierMiles Card overseas represents buying miles at 1.63 cents each.

Bonus Spending

Cardholders who make hotel bookings through Kaligo by 31 December 2022 will earn a total of 10 mpd. There’s also the option to earn 7 mpd on Agoda bookings up till 31 July 2022, for stays until 31 October 2022.

Do note that prices for bookings made through these links are likely to be inflated. It can still be worth it, however, depending on how much more it costs, and how much you value a mile.

When are Citi Miles credited?

Citi Miles are credited when your transaction posts, which generally takes 1-3 working days.

How are Citi Miles calculated?

Here’s how you can work out the Citi Miles earned on your Citi PremierMiles Card.

| Local Spend | Round down transaction to nearest S$1, then multiply by 1.2 Round to the nearest whole number |

| FCY Spend | Round down transaction to nearest S$1, then multiply by 2.0 Round to the nearest whole number |

This means the minimum spend required to earn miles is S$1.

If you’re an excel geek, here’s the formulas you need to calculate:

| Local Spend | =ROUND (ROUNDDOWN (X,0) *1.2,0) |

| FCY Spend | =ROUND (ROUNDDOWN (X,0) *2,0) |

| Where X= Amount Spent | |

For the full list of formulas that banks use to calculate credit card points, do refer to these articles:

What transactions aren’t eligible for Citi Miles?

The full list of ineligible transactions for Citi Miles can be found in the general Citi rewards T&Cs.

I’ve highlighted a few noteworthy categories below:

- Quasi cash transactions (MCC 6529-6540)

- Utilities payments (MCC 4900)

- Insurance (MCC 6300)

- Real Estate Agents and Managers (MCC 6513)

- Educational Institutions (MCC 8211-8299)

- Professional Services and Membership Organizations (MCC 8651-8661)

- Government Services (MCC 9000-9999)

- Top-ups to prepaid accounts like GrabPay and YouTrip

These exclusions mean that you can’t use the Citi PremierMiles Card for RentHero transactions, although CardUp will earn points as usual.

What do I need to know about Citi Miles?

| ❌ Expiry | ↔️ Pooling | ✈️ Transfer Fee |

| No expiry | No | S$26.75 per conversion |

Citi Miles never expire, so long as your card account is kept open. This isn’t a license to hold on to them indefinitely (doing so leaves you vulnerable to devaluations), but does give you some breathing room during periods like COVID-19.

Citibank has a policy of not pooling points across cards. If you have 12,000 Citi Miles on the Citi PremierMiles Card and 25,000 ThankYou points on the Citi Rewards Card, you will have to pay two separate conversion fees. This also means that you’ll need to transfer all your points out before cancelling the card, or else forfeit them.

Citibank has the widest variety of transfer partners in Singapore, with 12 airline and hotel programmes to choose from. This gives you access to some great sweet spots, like with British Airways Executive Club, Etihad Guest, and Turkish Miles&Smiles.

Points transfer at a 1:1 ratio, with a minimum transfer block of 10,000 miles.

| Frequent Flyer Programme | Conversion Ratio (Citi Miles: Partner) |

| 10,000: 10,000 | |

| 10,000: 10,000 | |

| 10,000: 10,000 | |

| 10,000: 10,000 | |

| 10,000: 10,000 |

| 10,000: 10,000 | |

| 10,000: 10,000 | |

| 10,000: 10,000 | |

| 10,000: 10,000 | |

| 10,000: 10,000 |

| 10,000: 10,000 |

Transfers cost S$26.75 per programme, regardless of how many points are transferred.

Citi Miles can also be redeemed for cash rebates at a dismal rate of 165 miles =S$1. There is absolutely no reason for you to take this option- you’d be better off using a cashback card if you did!

Other card perks

Two free lounge visits

The Citi PremierMiles is a relative rarity in its segment for having lounge access. Cardholders receive two free visits per year, via Priority Pass. At one point, the plan was to switch over to Dragon Pass, but it appears that’s been abandoned.

| Card | Lounge Access? |

BOC Elite Miles BOC Elite Miles | ✖ |

UOB PRVI Miles UOB PRVI Miles | ✖ |

OCBC 90N Mastercard OCBC 90N Mastercard | ✖ |

Citi PremierMiles Citi PremierMiles | ✔ (2 per year) |

DBS Altitude DBS Altitude | ✔ (2 per year, Visa version only) |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card | ✖ |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit Card | ✖ |

Do note that the allowance is tracked by calendar year. This is notably different from most other travel cards, which award free lounge visits by membership year.

In other words, if you get the Citi PremierMiles Card towards the end of the year, you could enjoy four lounge visits in quick succession (e.g. in December then January, since your allowance resets on 1 January).

Only the principal cardholder is entitled to this benefit. Lounge entitlements can be shared with a guest, but once you exhaust your free visits you’ll be charged US$32 per additional visit.

Buy miles with Citi PayAll

Citi PayAll is Citibank’s bill payment service, which allows cardholders to pay certain expenses with their credit cards and earn rewards in exchange for a 2% service fee:

- Rent

- Education

- Condo Fees

- Taxes

- Electricity Bills

Citi PremierMiles cardholders normally earn 1.2 mpd on PayAll transactions, which represents buying miles at 1.67 cents each.

However, from now till 31 July 2022, Citi PremierMiles cardholders will earn 2.5 mpd on PayAll with a minimum spend of S$5,000 and cap of S$120,000. This represents a cost of just 0.8 cents each, almost too good to pass up.

For the avoidance of doubt, Citi PayAll spending does count towards sign-up bonuses and other Citi promotions. This has been confirmed by Citi’s PR team.

Do Citi PayAll transactions count towards sign-up bonus spending?

Ad-hoc miles purchase promotions

Citibank runs periodic miles purchase promotions, which allow Citi PremierMiles Card members to buy additional miles after hitting a certain minimum spend.

A recent promotion in early 2020 allowed cardholders to buy miles from 0.97 cents each:

- Spend at least S$7,500, then pay S$215 to buy an additional 21,000 miles

- Spend at least S$14,000, then pay S$515 to buy an additional 53,200 miles

An even better offer came in 2017, when cardholders could buy miles from 0.76 cents each:

- Spend at least S$3,000, then pay S$58 to buy an additional 6,400 miles

- Spend at least S$9,000, then pay S$238 to buy an additional 31,200 miles

I don’t know how Citi makes money on these campaigns, but they’re fantastic opportunities for cardholders to top up their balance a cut-rate price.

Complimentary travel insurance with above average coverage

| Coverage | Amount |

| Accidental Death | S$1,000,000 |

| Medical Benefits | S$40,000 |

| Travel Inconvenience |

|

Complimentary travel insurance is offered by numerous cards, but not all policies are made equal. Some offer bare bones coverage, others are much more comprehensive.

Fortunately, the Citi PremierMiles Card falls into the latter category. Its AXA-underwritten policy offers up to S$40,000 of medical expense coverage, S$100,000 of emergency medical evacuation, and various travel inconveniences. COVID-19 coverage is not provided, however.

Coverage is activated when you use your Citi PremierMiles Card to pay for your round-trip airfare. For avoidance of doubt, paying for taxes and surcharges on an award ticket will trigger the coverage.

Summary Review: Citi PremierMiles Card

Its earn rates may not be the highest in the market, but the Citi PremierMiles Card still has a lot going for it- the widest range of transfer partners, lounge access, the opportunity to buy miles at very competitive rates, and good travel insurance coverage.

Throw in non-expiring miles and a decent sign-up bonus, and it’s a strong contender for the general spending slot in your wallet.

It’s just a shame that Citibank doesn’t pool points among its cards, and I really don’t get the need to use two different points currencies (at least it’s not as bad as OCBC, which has three).

So that’s my review of the Citi PremierMiles Card. What do you think?

| Overall Score | |

| ★★★★ | |

| Ratings Guide | |

| 5 Stars ★★★★★ | An essential card for miles chasers, with few viable alternatives |

| 4 Stars ★★★★ | A very good card, although other equally good alternatives may exist |

| 3 Stars ★★★ | A decent card to round out your collection, but not absolutely essential |

| 2 Stars ★★ | Very limited use cases, and outperformed by most other cards |

| 1 Star ★ | Paperweight. Use for picking teeth or ninja stars |

It’s a shame that the new cards are all issued under MC no more under visa network…. No chance for grab top up points 🙁

Lounge for 1st year only. Thereafter if U pay the card annual fee maybe U entitle to the lounge.

You get the 2 lounge visits every year regardless of whether you pay af

Hi Aaron, I was wondering, if we do not want miles for annual fee, can we get a waiver for annual fee?

Yes, worked for me for the past 6 years. Though I had to formally request to cancel the card one year before the waiver was granted.

sure, at citi’s discretion

Yes, I’ve been doing for the past few years.

I was also able to get the annual fee waived and keep the miles because I was charging a fair bit on the card.

YMMV

This series is great! What other cards are in the pipeline?

a lot…although i’m holding off on the hsbc and boc cards until they make their T&C changes. i’m feeling dbs altitude and uob prvi miles for the next 2.

Next review: DBS Altitude card please! 😀

Appreciate this review!

Hi Aaron,

U have any article that shares how to get the best deal out of which transfer partner for premier miles?

https://milelion.com/2019/06/03/british-airways-new-avios-chart-is-out-and-heres-how-the-sweet-spots-have-changed/

https://milelion.com/2018/12/24/good-value-star-alliance-bookings-with-turkish-airlines-miles-and-smiles/

https://milelion.com/2018/06/26/finding-the-sweet-spots-among-etihads-23-award-charts/

i just noticed that there is no more Sign-Up Bonuses if u sign up through Singsaver…..

not correct- sign-up bonus continues to be available via Singsaver

edit: the sign up bonus for new-to-bank customers where you pay the annual fee and get up to 40k (37.3k now) miles is valid via SS

the other offer where you ask for a waiver and get up to 10k miles is not

Drop me an email via contact us and I’ll ask Singsaver to look at your case

Do you mean the 1st year annual fee waiver offer where you get 13200 bonus miles does not stack with singsaver bonus?

My first CC and I still use it frequently.

Are we able to earn miles paying insurance through ipaymy?

Updates to Citi Asia miles?

Noticed this in the Citi PM T&C: asia miles is 1 Citi Mile = 0.4 Asia Miles

4.3 The cardmember can use Citi Miles to redeem for FFP miles/points at the redemption rate of 1 Citi Mile = 1 FFP mile (except for Asia Miles FFP where the redemption rate is 1 Citi Mile = 0.4 Asia Miles).

this is from the 2012 T&Cs file.

Do grab top ups using premiermiles Visa still earn miles?

hi Aaron, since PM card is transitioning from Visa to MC, upon card expiry and renewal, will citi keep our miles and uphold the never expire miles?

if your card is switched from visa to mc, your points will be transferred accordingly

Does this card award miles for grab top ups and paying grB transactions?

Hi Aaron,

Is paying the annual fee for the 10000 miles worthed it? I mean if we earn 1.2mpd wouldn’t paying $193 = 231 miles only? I know I’m thinking too simply but I really do not understand. Some other review sites say these 10000 miles only have a value of $100 but for example if I buy spend $100 locally on retail wouldn’t that get me 102 miles only? Appreciate if you could help enlighten me

Thank you for the update. Anyone has experience booking hotel through Kaligo with Citibank card? My hotel bookings were in early March but the 10 miles has yet to be given out. As of now, I only received the base points of 1.2miles.

I use this card for Kaligo a lot. You have to phone in every time to ask them to credit the bonus milesbut they do award 10Mpd, provided you booked through their dedicated link

Is this statement really correct? “Existing Visa cards can continue to be used until expiry. ”

I had an expiring Citi Visa card. I called to ask for a Visa card replacement and they gave one to me with no problems. The CSO told me that unless the customer gave the consent for a Mastercard replacement, they would still give out Visa.

My expired Visa card was automatically replaced with a new one. For what it is worth, I have both the Mastercard and Visa version—the former paired with Amaze as a card of last resort.

Which is more lucrative, running it through Amaze card to pay in SGD or charge it directly in FCY for this card?

Am I required to pay the annual fee for the first year in order to receive the 10,000 miles?

is there a cap to the number of miles per month/transection?

ie is this card good for adhoc large spends