Here’s The MileLion’s review of the AMEX KrisFlyer Credit Card, the entry-tier cobrand card on the Singapore Airlines-AMEX hierarchy.

As a starter card, it’s certainly got some appeal. A first year fee waiver, generous sign-up bonuses, and free transfers to KrisFlyer will ease anyone into the miles game. On the other hand, its earn rates are mediocre, and it doesn’t actually have a whole lot of Singapore Airlines benefits for a cobrand card.

Is it time to graduate?

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card | |

| ★★★ | |

| The AMEX KrisFlyer Credit Card is a useful starter card, but should be a stepping stone rather than a permanent solution. | |

| 👍 The good | 👎 The bad |

|

|

| 💳 Full List of Credit Card Reviews | |

Overview: AMEX KrisFlyer Credit Card

Let’s start this review by looking at the key features of the AMEX KrisFlyer Credit Card

| |||

| Apply Here | |||

| Income Req. | S$30,000 p.a. | Points Validity | 3 years |

| Annual Fee | S$176.55 | Min. Transfer | N/A |

| Miles with Annual Fee | N/A | Transfer Partners |

|

| FCY Fee | 2.95% | Transfer Fee | N/A |

| Local Earn | 1.1 mpd | Points Pool? | Yes |

| FCY Earn | 1.1 mpd 2.0 mpd (Jun & Dec) | Lounge Access? | No |

| Special Earn | 2.0 mpd on SIA 3.1 mpd on Grab | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

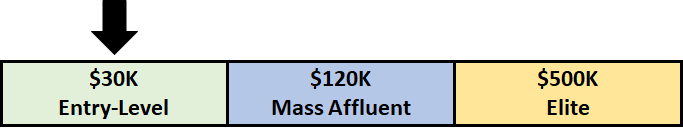

Remember that there’s a total of four Singapore Airlines AMEX cobrand cards. The AMEX KrisFlyer Credit Card (sometimes referred to as the “KrisFlyer Blue”) is positioned at the entry level, with the AMEX KrisFlyer Ascend one step above it. The AMEX PPS and Solitaire PPS Credit Cards can only be held by PPS and Solitaire PPS members respectively.

| Min. Income | Annual Fee | |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card | S$30,000 | S$176.55 (FYF) |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend | S$50,000 | S$337.05 |

AMEX PPS Credit Card* AMEX PPS Credit Card* | S$30,000 | S$551.05 (FYF) |

AMEX Solitaire PPS Credit Card^ AMEX Solitaire PPS Credit Card^ | S$30,000 | S$551.05 (FYF) |

| *Only available to PPS Club members ^Only available to Solitaire PPS Club members | ||

How much must I earn to qualify for an AMEX KrisFlyer Credit Card?

The AMEX KrisFlyer Credit Card has an income requirement of S$30,000 per year, the MAS-mandated minimum. This is S$20,000 lower than the income requirement of the AMEX KrisFlyer Ascend, reflecting its entry-level positioning.

Since American Express is not a deposit-accepting bank in Singapore, there is no option to obtain a secured version of this card.

How much is the AMEX KrisFlyer Credit Card’s annual fee?

| Principal Card | Supp. Card | |

| First Year | Free | First 2 free 3rd onwards: S$53.50 |

| Subsequent | S$176.55 | S$53.50 |

The AMEX KrisFlyer Credit Card has an annual fee of S$176.55 for the principal cardholder, which is waived for the first year. The first two supplementary cards enjoy a first year fee waiver; the third card onwards has a S$53.50 fee.

American Express does not stipulate a minimum spend amount to qualify for a fee waiver, but based on personal experience, it’s not difficult to get for this card.

How many miles do I earn?

| 🇸🇬 SGD Spend | 🌎 FCY Spend | ➕ Bonus Spend |

| 1.1 mpd | 2.0 mpd (Jun & Dec only, otherwise 1.2 mpd ) | 2.0 mpd on SIA and KrisShop, 3.1 mpd for Grab |

SGD/FCY Spend

AMEX KrisFlyer Credit Card members earn 1.1 miles for every S$1 spent in Singapore Dollars and foreign currency (FCY). In June and December, the FCY earn rate is boosted to 2.0 miles for every S$1 spent.

These are very mediocre rates, considering the competition is offering up to 1.4 and 2.4 mpd on local and FCY spend, year round!

| Cards | Local MPD | FCY MPD |

UOB PRVI Miles UOB PRVI Miles | 1.4 | 2.4 |

OCBC 90°N Mastercard OCBC 90°N Mastercard | 1.2 | 2.1 |

Citi PremierMiles Citi PremierMiles | 1.2 | 2.0 |

DBS Altitude DBS Altitude | 1.2 | 2.0 |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend | 1.2 | 2.0* |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card | 1.1 | 2.0* |

OCBC 90°N Visa OCBC 90°N Visa | 1.0 | 2.0 |

BOC Elite Miles BOC Elite Miles | 1.0 | 2.0 |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit Card | 1.2 | 1.2 |

| *June and Dec only, otherwise 1.1 mpd | ||

All overseas transactions on the AMEX KrisFlyer Credit Card are subject to a 2.95% fee. This was increased from 2.5% in 2020, but remains one of the lowest fees on the market.

Using your card overseas therefore means buying miles at 1.48 cents (not bad) or 2.68 cents (very bad), depending on time of year.

| Months | FCY Spend | Cost Per Mile |

| June & December | 2.0 mpd | 1.48 |

| Others | 1.1 mpd | 2.68 |

Bonus Spending

AMEX KrisFlyer Credit Card cardholders earn 2.0 mpd on all transactions made with Singapore Airlines and KrisShop, without cap. Unfortunately, there is no bonus for Scoot transactions.

Since it’s possible to earn 4 mpd on Singapore Airlines and KrisShop with the DBS Woman’s World Card or HSBC Revolution, this isn’t a particularly attractive rate.

AMEX KrisFlyer Credit Card cardholders also receive a bonus 2.0 mpd on all Grab transactions, up to S$200 per calendar month. This means a total of 3.1 mpd on the first S$200 of spend. All Grab services are included, but GrabPay top-ups are excluded.

Again, you could earn 4 mpd on Grab transactions with the DBS Woman’s World Card, Citi Rewards or HSBC Revolution, so this isn’t that big a deal.

When are KrisFlyer Miles credited?

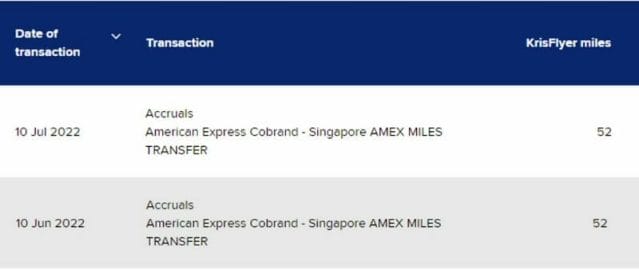

Miles earned on the AMEX KrisFlyer Credit Card are batched and credited to your KrisFlyer account once a month.

You can typically expect to see them credited around the end of your statement period.

How are KrisFlyer miles calculated?

Here’s how KrisFlyer miles earned on the AMEX KrisFlyer Credit Card are calculated:

| Local Spend | Multiply transaction by 1.1, then round to the nearest whole number |

| FCY Spend | Multiply transaction by 2 (in Jun/Dec) or 1.1 (otherwise), then round to the nearest whole number |

Notice how the transaction is not rounded down to the nearest S$1; instead, it’s multiplied by 1.1/2 straight away. This means the minimum spend to earn points is S$0.46 (SGD) or S$0.25 (FCY).

This beneficial rounding policy allows the AMEX KrisFlyer Credit Card to compete favourably with ostensibly higher-earning cards like the UOB PRVI Miles (1.4 mpd), at least where smaller transactions are concerned:

AMEX KrisFlyer Card AMEX KrisFlyer CardEarn rate: 1.1 mpd |  UOB PRVI Miles UOB PRVI MilesEarn rate: 1.4 mpd | |

| S$5 | 6 miles | 6 miles |

| S$9.99 | 11 miles | 6 miles |

| S$15 | 17 miles | 20 miles |

| S$19.99 | 22 miles | 20 miles |

| S$25 | 28 miles | 34 miles |

If you’re an excel geek, here’s the formulas you need to calculate miles:

| Local Spend | =ROUND (X*1.1,0) |

| FCY Spend | =ROUND (X*2,0) |

| Where X= Amount Spent | |

For the full list of formulas that banks use to calculate credit card points, do refer to these articles:

What transactions aren’t eligible for KrisFlyer Miles?

The good news is that American Express has the fewest rewards exclusions of any card issuer in Singapore.

A full list of exclusions can be found here, but the main ones to note are:

- GrabPay top-ups

- Insurance premiums

- SPC transactions

- Utilities

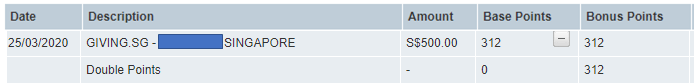

Apart from that, anything goes. You will earn miles for transactions which are commonly excluded by other banks, such as hospitals, government payments (if AMEX is even accepted), membership fees and even charitable donations, as the screenshot below shows:

For avoidance of doubt, CardUp transactions will earn miles with this card at the regular rate of 1.1 mpd.

What do I need to know about KrisFlyer miles?

The AMEX KrisFlyer Credit Card credits KrisFlyer miles directly to your account on a monthly basis, with no conversion fees.

This is a mixed blessing. On the one hand, you save on the usual ~S$25 conversion fee that most banks charge. On the other, direct crediting means the 3 year expiry countdown for KrisFlyer miles starts immediately. Contrast this to other cards where you enjoy “two validities”- one on the bank side, and one on the airline side.

In case you were worried, cancelling your AMEX KrisFlyer Credit Card has no impact on KrisFlyer miles already in your account.

I currently value KrisFlyer miles at 1.5 Singapore cents each, which represents the upper limit I’d be willing to pay. That said, it’s certainly possible to get more than 2 Singapore cents of value per mile for redemptions, and it really boils down to the individual and his/her earning and burning patterns.

For more thoughts on the matter, refer to the article below.

Other card perks

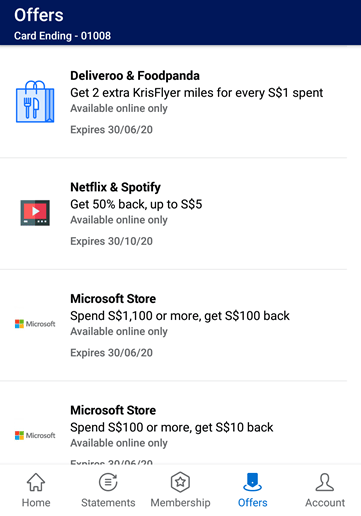

AMEX Offers

AMEX Offers are targeted deals pushed to your AMEX app, which can range from small savings like getting a few dollars back on contactless transactions, to much more substantial offers like S$75 off a S$300 Hilton transaction. They can also take the form of bonus miles promotions, like a bonus 2.0 mpd on Deliveroo and foodpanda.

Upgrade path to AMEX KrisFlyer Ascend

If you’re planning on graduating from the AMEX KrisFlyer Credit Card but don’t quite meet the income requirement of the AMEX KrisFlyer Ascend, American Express offers an “upgrade path”.

Customers who hold the AMEX KrisFlyer Credit Card for a minimum of nine months and spend at least S$10,000 within 12 consecutive months can opt to upgrade to an AMEX KrisFlyer Ascend.

American Express will throw in 12,000 bonus miles or a S$150 statement credit as a reward for upgrading and paying the S$337.05 annual fee.

S$150 cashback for Singapore Airlines

Cardholders who charge S$12,000 or more to their AMEX KrisFlyer Credit Card between 1 July and 30 June of the following year will receive S$150 cashback, valid on their next purchase of Singapore Airlines air tickets via singaporeair.com or the SingaporeAir mobile app.

To utilise the cashback, you must charge your air tickets to your AMEX KrisFlyer Credit Card. This only applies to flights originating from Singapore, and purchased in Singapore dollars.

The cashback is valid for 12 months, and will appear on your billing statement within 90 days of purchase. Ticket purchases via AMEX Pay Small do not qualify.

Complimentary travel insurance

| Accidental Death | S$350,000 |

| Medical Expenses | N/A |

| Travel Inconvenience | Missed connection: S$400 Baggage Delay: S$400 Extended Baggage Delay: S$1,000 Flight Delay: S$400 |

The Chubb coverage provided by the AMEX KrisFlyer Credit Card offers S$350,000 coverage for accidental death or permanent disability while traveling on a public conveyance. There’s also coverage for travel inconveniences like missed connections and bag delays.

However, there is no coverage for medical expenses, nor medical evacuation. This is something you can’t afford to miss, so a separate travel insurance policy is almost mandatory.

On the bright side, Chubb has confirmed that insurance coverage also applies to award tickets, so long as you use your AMEX credit card to pay the taxes and surcharges.

Summary Review: AMEX KrisFlyer Credit Card

|

| Apply Here |

The relatively no-frills nature of the AMEX KrisFlyer Credit Card means it’s best thought of as a starter card.

A fresh graduate could apply for this as their first miles card, earn the sign-up bonus and have the miles deposited with no transfer fees, then graduate to the AMEX KrisFlyer Ascend when their income crosses the S$50,000 mark (or via spending at least S$10,000 in a 12-month period). Remember: holding this card will not disqualify you from the AMEX KrisFlyer Ascend’s sign-up bonus, as and when that time comes.

Alternatively, they may wish to consider the KrisFlyer UOB Credit Card instead, which offers more competitive earn rates of up to 3 mpd on Singapore Airlines tickets, food delivery, online shopping and travel, dining and transport.

So that’s my review of the AMEX KrisFlyer Credit Card. What do you think?

| Overall Score | |

| ★★★ | |

| Ratings Guide | |

| 5 Stars ★★★★★ | An essential card for miles chasers, with few viable alternatives |

| 4 Stars ★★★★ | A very good card, although other equally good alternatives may exist |

| 3 Stars ★★★ | A decent card to round out your collection, but not absolutely essential |

| 2 Stars ★★ | Very limited use cases, and outperformed by most other cards |

| 1 Star ★ | Paperweight. Use for picking teeth or ninja stars |

As you rightly pointed out, this card should be called the Amex Sign Up Bonus Credit Card cos that is all it really is good for

For the SQ $150 cashback, is it applicable for taxes that I pay when I make a redemption booking?

Yes.

Between the upgrade path and separate sign-up path to the KF ascend, what are your thoughts?

Hi there, the link to sign up seems to be broken

Thanks for the valuable info!

You state that “Apart from that, anything goes”, but according to AMEX, only a very small places earn you miles. It’s not any transaction. For example, I asked rather using the card in any food court or shopping mall will earn me points, and they said no. That only very specific companies with which they work with will provide miles. Did I misunderstood?