Here’s The MileLion’s review of the American Express Platinum Credit Card, which caused quite a stir when it launched in Singapore back in 2004.

Up till then, the idea of “platinum” was sacrosanct. Most cards carrying the label had a minimum income requirement of S$100,000, or were by invitation only. But the AMEX Platinum Credit Card halved that to a mere S$50,000- the industry average for a gold card at the time. That led one advertising executive to dismiss it as a “white gold card” that would “taint the appeal of other platinum credit cards among society’s creme de la creme” (I have it on good authority it should not be pronounced “creamy de lah creamy””).

AMEX disputed that assessment, of course, saying they expected the average Platinum Credit Card holder to earn close to S$125,000 a year. Eager to dispel notions that it might be a poor man’s platinum, its advertisements marketed it as a heavyweight offering. One showed the card weighing down a man’s suit pocket, another showed the card in a handbag bending a chair out of shape (either that, or someone really needs Jenny Craig). Lifestyle perks included complimentary golf, a Feed at Raffles membership (remember that?), and spa packages.

Fast forward to today, and perhaps that advertising exec was right. The platinum label has lost all meaning, given that a penniless student can get his or her hands on a platinum debit card.

So what does that mean for the AMEX Platinum Credit Card- is it the right precious metal for you?

AMEX Platinum Credit Card AMEX Platinum Credit Card | |

| ★★★ | |

| The AMEX Platinum Credit Card isn’t a great choice for spending, though Love Dining and Chillax benefits can make it worth your while. | |

| 👍 The good | 👎 The bad |

|

|

| 💳 Full List of Credit Card Reviews | |

Overview: AMEX Platinum Credit Card

| |||

| Apply Here | |||

| Income Req. | S$80,000 p.a. | Points Validity | No expiry |

| Annual Fee | S$321 | Min. Transfer | 450 MR points (250 miles) |

| Miles with Annual Fee | N/A | Transfer Partners |

|

| FCY Fee | 2.95% | Transfer Fee | None |

| Local Earn | 0.69 mpd | Points Pool? | Yes |

| FCY Earn | 0.69 mpd | Lounge Access? | No |

| Special Earn | 3.47 mpd on 10Xcelerator merchants | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

The AMEX Platinum Credit Card suffers from something of an identity crisis, because American Express has three different Platinum cards with similar sounding names.

| Min. Income | Annual Fee | Earn Rate | |

AMEX Platinum Credit Card AMEX Platinum Credit Card | S$80K | S$321 | 0.69 mpd |

AMEX Platinum Reserve AMEX Platinum Reserve | S$150K | S$535 | 0.69 mpd |

AMEX Platinum Charge AMEX Platinum Charge | S$200K | S$1,712 | 0.78 mpd |

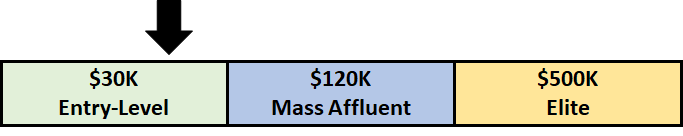

The AMEX Platinum Credit Card is positioned as the entry-level offering, two rungs below the AMEX Platinum Charge (S$200K minimum income) and one rung below the AMEX Platinum Reserve (S$150K minimum income).

Be careful not to confuse the three, as they have different annual fees, earn rates & transfer ratios (at least for the AMEX Platinum Charge) and benefits.

How much must I earn to qualify for an AMEX Platinum Credit Card?

On paper, the AMEX Platinum Credit Card has a minimum income requirement of S$80,000 per annum. This was increased from S$50,000 as part of the 2020 makeover.

However, I’ve read numerous data points of readers getting approved at the previous S$50,000 mark, which leads me to believe this is more of a cosmetic repositioning than a hard and fast rule.

Remember: any income requirement above S$30,000 is essentially arbitrary (it can affect the credit limit granted, but not approval per se). If you fancy the benefits of this card, it doesn’t hurt to send in an application- the worst they can say is no. An unsuccessful credit card application, in and of itself, does not have a negative impact on your credit score.

How much is the AMEX Platinum Credit Card’s annual fee?

| Principal Card | Supp. Card | |

| First Year | S$321 | First 2 free, S$160.50 for 3rd onwards |

| Subsequent | S$321 | First 2 free, S$160.50 for 3rd onwards |

The AMEX Platinum Credit Card has an annual fee of S$321 for the principal cardholder. The first two supplementary cards are free for life, and the third onwards costs S$160.50.

While the first year’s annual fee cannot be waived (unless you sign up through the special promotion with POEMS, see next section), subsequent year’s fees may be waived at AMEX’s discretion.

What sign-up bonus or gifts are available?

From now till 30 September 2022, American Express is partnering with POEMS by Philip Securities to offer a first year annual fee waiver on the AMEX Platinum Credit Card.

To enjoy a fee waiver:

- Open a free POEMS account via this link

- Fill up the the online interest form via this link

- You’ll receive a unique application link via email within 3-5 working days. Apply for the AMEX Platinum Credit Card via the link within 7 calendar days

There is no minimum funding or trading requirement for your POEMS account.

For avoidance of doubt, the annual fee waiver offer only applies to those who do not currently hold an AMEX Platinum Credit Card (it’s fine if you already hold other AMEX cards). Applicants will not be eligible for any other sign-up gifts if they opt for the fee waiver.

How many miles do I earn?

| 🇸🇬 SGD Spend | 🌎 FCY Spend | ➕ Bonus Spend |

| 0.69 mpd | 0.69 mpd | 3.47 mpd on 10Xcelerator |

SGD/FCY Spend

AMEX Platinum Credit Card cardholders earn 2 Membership Rewards point for every S$1.60 spent in Singapore Dollars or foreign currency (FCY). 450 MR points are worth 250 airline miles, so that’s an equivalent earn rate of 0.69 mpd for both local and FCY spending.

All foreign currency transactions are subject to a 2.95 % fee.

Bonus Spending

|

| AMEX 10Xcelerator |

AMEX Platinum Credit Card cardholders earn 10 MR points per S$1.60 spent at 10Xcelerator merchants (formerly known as Platinum EXTRA). This is an effective earn rate of 3.47 mpd, and there is no cap on the maximum bonus that can be earned.

10Xcelerator merchants include:

- 1-Group restaurants (1-Atico, Bee’s Knees, Botanico, Mimi, Monti, UNA, Zorba and more)

- American Tourister

- IWC

- Lee Hwa Jewellery

- Leica

- Mazda

- Miele

- PARKROYAL COLLECTION Pickering and Marina Bay

- Samsonite

- The Hour Glass

The full list of 10Xcelerator merchants can be found here.

An earn rate of 3.47 mpd obviously pales in comparison to the 4 mpd you could earn via contactless payments with the UOB Preferred Platinum Visa and UOB Visa Signature, but the key thing to remember is that it’s uncapped. If you’re making a big ticket purchase (car down payment, fancy watch), then this could be useful.

When are MR points credited?

Base and bonus MR points are credited when your transaction posts, which generally takes 1-3 working days.

How are MR points calculated?

Here’s how you can work out the MR points earned on your AMEX Platinum Credit Card.

| Base Points | Divide transaction by 1.6, then round down to the nearest whole number. Multiply by 2 |

| 10Xcelerator | Divide transaction by 1.6, then round down to the nearest whole number. Multiply by 8 |

This means the minimum spend required to earn miles is S$1.60.

If you’re an Excel geek, here’s the formulas you need to calculate your points:

| Base Points | =ROUNDDOWN(X/1.6,0)*2 |

| 10Xcelerator | =ROUNDDOWN(X/1.6,0)*8 |

| Where X= Amount Spent | |

For the full list of formulas that banks use to calculate credit card points, do refer to these articles:

What transactions aren’t eligible for MR points?

American Express cards have a relatively short exclusions list, at least compared to other banks in Singapore.

A full list of ineligible transactions can be found in the AMEX T&Cs. The main exclusions to take note of are:

- Insurance premiums

- GrabPay top-ups

- Public hospitals and polyclinics (from 1 Oct 2022)

- Singapore Petroleum Company (SPC) transactions

- Utilities

Do note that charitable donations, educational institutions, and government payments will earn points; the bigger question is whether AMEX cards are accepted in the first place.

For avoidance of doubt, CardUp transactions will earn points with all AMEX credit cards.

What do I need to know about MR points?

| ❌ Expiry | ↔️ Pooling | ✈️ Transfer Fee |

| No expiry | Yes | N/A |

Expiry

MR points earned on the AMEX Platinum Credit Card never expire so long as the card account remains active.

Pooling

MR points earned from different American Express cards are pooled together, but it’s slightly complicated.

If you hold an AMEX Platinum Credit Card and an AMEX Platinum Charge, there are two possibilities.

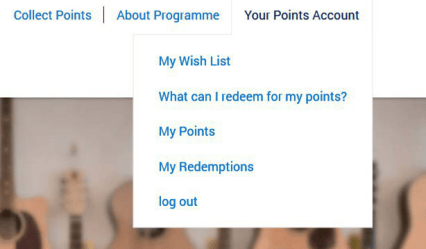

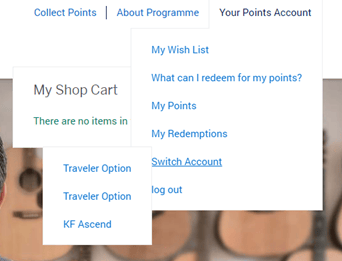

(1) Some people will see their points pooled automatically on the back end, all convertible at the more advantageous 400:250 rate offered to AMEX Platinum Charge cardholders. If you’re in this situation, the drop down menu for “Your Points Account” will look like this.

(2) Some people will not see their points pooled on the back end. Instead, they’ll have one points account for their AMEX Platinum Charge, and another points account for their AMEX Platinum Credit Card. If you’re in this situation, the drop down menu for “Your Points Account” will have a “Switch Account” button to toggle between points balances.

In this case, you can call up customer service to get your points manually combined and transferred at the more advantageous 400:250 rate.

Transfer Partners & fees

American Express has 11 airline and hotel transfer partners, with MR points transferring at the following ratios:

| Programme | Conversion Ratio (MR Points: Partner) |

| 450:250 | |

| 450:250 | |

| 450:250 | |

| 450:250 | |

| 450:250 | |

| 450:250 |

| 450:250 | |

| 450:250 | |

| 450:250 |

| 1,000:1,000 |

| 1,000:1,250 |

All transfers are free of charge.

If you happen to hold the AMEX Platinum Credit Card and AMEX Platinum Charge at the same time, you can transfer all your MR points to the nine airline partners at a rate of 400 MR points = 250 miles. Transfer ratios for hotel partners remain the same.

Other benefits

AMEX Love Dining

|

| Hotels |

| Restaurants |

| T&Cs |

AMEX Platinum Credit Card cardholders enjoy Love Dining benefits, with up to 50% off food (not beverages) at more than 30 restaurants and hotels across Singapore.

| Number of Diners | Discount on Food Bill |

| Card member | 15%^ |

| Card member + 1 guest | 50% |

| Card member + 2 guests | 35%^ |

| Card member + 3 guests | 25% |

| Card member + 4-19 guests | 20% |

| ^10% and 33% respectively at Fairmont Singapore, Swissotel The Stamford, Paradox Singapore Merchant Court | |

The full list of participating restaurants can be found below:

| |

| Restaurants | |

|

|

| Hotels | |

|

|

Each diner must order at least one qualifying food item (usually a main course) to enjoy the discount. Blackout dates apply, namely public holidays and eve of public holidays, plus special occasions like Valentine’s Day.

What I particularly like about Love Dining is that it’s not 1-for-1, it’s 50% off. With 1-for-1, you only get the cheaper item free, and everything else you buy is at the regular price. With 50% off, you save on everything (except drinks)- appetisers, mains, desserts. No more feeling compelled to order a more expensive item because your partner did, and at more upscale restaurants, the savings can easily add up to S$100+ per visit.

Unfortunately, the list of AMEX Love Dining hotels and restaurants seems to be shrinking all the time. Over the past couple of years, we’ve seen Conrad Centennial, Capitol Kempinski, Fullerton Hotel, and Fullerton Bay Hotel drop out of the programme, as well as TWG, Praelum Wine Bistro, and Paulaner Brauhaus. Replacements have not been added at the same rate, and without naming names, tend to be lesser lights.

Further exclusions have been added on certain menu items (particularly the more expensive ones like A5 Japanese Wagyu at Sen of Japan), and it’s safe to say that Love Dining is nowhere as big a draw as it was pre-COVID.

AMEX Chillax

|

| Bars |

AMEX Platinum Credit Card cardholders also enjoy 1-for-1 drinks and special offers with Chillax. Here’s the full list of participating outlets for 2022.

| |

| Participating Outlets | |

|

|

Like Love Dining, the Chillax partners list has been steadily chipped away. Gone are bars like Horse’s Mouth, Smoke & Mirrors, Monti and Portman’s, and the current list is as small as I can ever remember.

Still, I do enjoy going down to Anti:dote and having two glasses of champagne at just S$17- the Chillax benefit stacks with a further 20% discount they offer for AMEX Platinum cardholders.

Platinum Golf

AMEX Platinum Credit Card members enjoy complimentary green fees at more than 40 golf clubs in Singapore, Cambodia, Philippines, Malaysia, Indonesia, Thailand and Vietnam.

- Weekday visits require one paying guest to enjoy complimentary green fees

- Weekend visits require two paying guests to enjoy complimentary green fees

Participating clubs in Singapore include Keppel Club, Orchid Country Club, Sembawang Country Club, and Warren Golf & Country Club. A complete list can be found here.

Return guarantee benefit and purchase protection

Items purchased with the AMEX Platinum Credit Card are eligible for complimentary return guarantee benefit and purchase protection.

The return guarantee states that if an eligible item cannot be returned within 90 days of purchase, the insurer will take the item off his/her hands for a maximum of S$800.

Purchase protection states that if an eligible item is stolen or damaged within 90 days of purchase, the insurer will replace or repair it for up to S$10,000.

The full T&Cs of this policy can be found here.

Summary Review: AMEX Platinum Credit Card

|

| Apply Here |

In some ways, the AMEX Platinum Credit Card (and all AMEX Platinum cards for that matter) is extremely frustrating. MR points don’t expire and can be transferred to a wide variety of transfer partners with no conversion fees. But the earn rate is so mediocre that you won’t be accumulating any significant volume of points, unless perhaps you’re a heavy patron of 10Xcelerator merchants.

So what’s the real draw here? Love Dining and Chillax. These two programmes are decidedly less mighty than they were a few years ago, but there’s still some very decent restaurants on the list (SKIRT, Sen of Japan, La Nonna and Wooloomooloo are some of my favourites), and if you can take advantage of the first year fee waiver via POEMS, I see no reason not to.

So that’s my review of the AMEX Platinum Credit Card. What do you think?

| Overall Score | |

| ★★★ | |

| Ratings Guide | |

| 5 Stars ★★★★★ | An essential card for miles chasers, with few viable alternatives |

| 4 Stars ★★★★ | A very good card, although other equally good alternatives may exist |

| 3 Stars ★★★ | A decent card to round out your collection, but not absolutely essential |

| 2 Stars ★★ | Very limited use cases, and outperformed by most other cards |

| 1 Star ★ | Paperweight. Use for picking teeth or ninja stars |

I’ve always found this card useful as it’s really the only option you have at THG for solid earn rates outside of sign on bonuses. They really could be doing better with Love Dining merchants though, the programme is perhaps just 2 or 3 more departures from being shite.

I only have this card in hope they’ll give me upgrade to plat charge

I have this card for the sole reason of Love Dining offer with free 1st year subscription.

Not exactly free with POEMS T&C for the promotion.

POEMS Account Holders will need to purchase a total transaction value of SGD 1.25 million in wholesale bonds or 5 transactions in multiples of SGD 250,000 in nominal value of the traded wholesale bond through a single POEMS Account to enjoy the Annual Fee rebate of SGD1,600 (exclusive of GST).

Do note that you would have to pay for the annual fee first (SGD 1,712 inclusive of GST) and Phillip Securities Pte Ltd (PSPL) will rebate SGD 1,600 (exclusive of GST) to your POEMS Account once the criteria are met.

This refers to the Amex platinum charge. This article is on the Amex platinum credit card

I see, thanks for the clarification!

Hi, has anybody used the Hotel Room upgrade vouchers before? They don’t specify how much of an upgrade we get from it, so I’m curious if it bumps up our room class by 1 or if they’re generous enough to go all the way.

Thanks!