Here’s The MileLion’s review of the OCBC VOYAGE Card, which launched in 2015 as OCBC’s first-ever miles card.

That’s right- it might surprise you to know that the upmarket VOYAGE predates the mass market 90°N by nearly six years. While most banks go broad before going niche, OCBC did things the other way round. It’s an interesting approach to say the least, but that’s another discussion for another time.

As OCBC’s flagship card, the VOYAGE has a lot resting on its shoulders. And while it’s not necessarily the best in class for every area, it has just enough differentiation to make it more than another “me too” offering.

OCBC VOYAGE OCBC VOYAGE | |

| ★★★1/2 | |

| The OCBC VOYAGE isn’t the best in class at all it does, but its unique proposition of “any seat, any flight” redemptions make it a useful tool to have. | |

| 👍 The good | 👎 The bad |

|

|

| 💳 Full List of Credit Card Reviews | |

Overview: OCBC VOYAGE

Let’s start this review by looking at the key features of the OCBC VOYAGE Card.

| |||

| Apply Here | |||

| Income Req. | S$120,000 p.a. | Points Validity | No expiry |

| Annual Fee | S$492.50 | Min. Transfer | 1 VOYAGE Mile (1 mile) |

| Miles with Annual Fee | 15,000 | Transfer Partners |

|

| FCY Fee | 3.25% | Transfer Fee | S$25 |

| Local Earn | 1.3 mpd | Points Pool? | No |

| FCY Earn | 2.2 mpd | Lounge Access? | Yes |

| Special Earn | N/A | Airport Limo? | Yes |

| Cardholder Terms and Conditions | |||

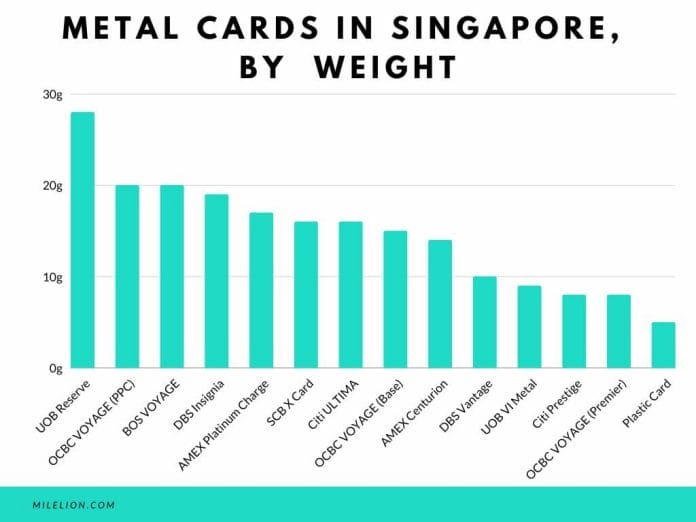

The OCBC VOYAGE comes in metal card stock, duralumin to be precise. Duralumin is a strong, hard and lightweight aluminium alloy that contains copper, manganese, iron, and silicon, and is resistant to acid and seawater corrosion. I suppose that means you can go swimming with your VOYAGE card (because why wouldn’t you?)

The latest version of the VOYAGE card weighs in between 8-20g.

Why the range of weights? Because there’s actually four versions of the VOYAGE. In addition to the basic OCBC VOYAGE, you have:

- OCBC Premier VOYAGE, for clients of OCBC Premier (min. AUM S$200K)

- OCBC PPC VOYAGE, for clients of OCBC Premier Private Client (min. AUM S$1M)

- BOS VOYAGE, for clients of Bank of Singapore (min. AUM S$5M)

The main difference between the cards is the earn rate, as summarised in the table below:

| 💳 OCBC VOYAGE Cards | |||

| Card | Annual Fee | Local | FCY |

OCBC VOYAGE OCBC VOYAGE | S$492.50 | 1.3 mpd | 2.2 mpd |

OCBC Premier VOYAGE OCBC Premier VOYAGE | S$492.50 | 1.6 mpd | 2.3 mpd |

OCBC PPC VOYAGE OCBC PPC VOYAGE | Waived | 1.6 mpd* | 2.3 mpd* |

BOS VOYAGE BOS VOYAGE | S$492.50 | 1.6 mpd | 2.3 mpd |

| *2.3 mpd for local and overseas dining | |||

The OCBC PPC VOYAGE and BOS VOYAGE get Tower Club access (albeit as an associate member, with a 10% surcharge on all F&B consumption on top of the usual GST and service charge), but apart from that the benefits are the same.

In this review, I’ll be focusing on the basic version of the OCBC VOYAGE Card.

How much must I earn to qualify for an OCBC VOYAGE?

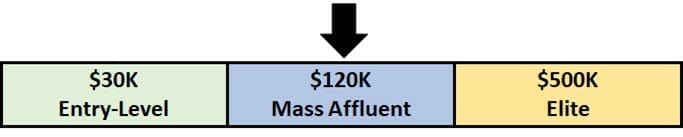

The OCBC VOYAGE has a minimum income requirement of S$120,000 p.a..

If you fall short of that mark but are otherwise asset rich, you can deposit S$200,000 with OCBC to get OCBC Premier status. This allows you to get the OCBC Premier VOYAGE with a minimum income of just S$30,000 p.a..

How much is the OCBC VOYAGE’s annual fee?

| Principal Card | Supp. Card | |

| First Year | S$492.50 | First 2 free 3rd onwards: S$189 |

| Subsequent | S$492.50 | S$189 |

The OCBC VOYAGE has an annual fee of S$492.50. Up to two supplementary cards are free for the first year, and S$189 per annum subsequently.

Cardholders who spend at least S$60,000 in a membership year (S$30,000 for Premier version) will receive an annual fee waiver.

15,000 VOYAGE Miles will be awarded for paying the annual fee, which works out to about 3.28 cents per mile.

Alternatively, cardholders can opt to pay a $3,240 annual fee to receive 150,000 KrisFlyer miles (2.16 cents per mile).

Note that if you pick this option, you will receive KrisFlyer miles and not VOYAGE Miles (VOYAGE Miles can be converted into KrisFlyer miles, but not the other way round). As we’ll see later in this post, 1 VOYAGE Mile is more valuable than 1 KrisFlyer mile, though it’s hard to pin down an exact valuation.

How many miles do I earn?

| 🇸🇬 SGD Spend | 🌎 FCY Spend | ➕ Bonus Spend |

| 1.3 mpd | 2.2 mpd | N/A |

SGD/FCY Spend

OCBC VOYAGE cardholders earn:

- 1.3 VOYAGE Miles for every S$1 spent in Singapore Dollars

- 2.2 VOYAGE Miles for every S$1 spent in foreign currency (FCY)

1 VOYAGE Mile is worth 1 KrisFlyer mile, so that’s an equivalent earn rate of 1.3 mpd for local spend and 2.2 mpd for FCY spend.

These are fairly competitive rates compared to other cards in the $120K segment, although OCBC’s punitive rounding policy (discussed later in this article) will result in a lower average mpd on smaller transactions.

| Card | SGD | FCY |

SCB VI SCB VI | Up to 1.4 mpd* | Up to 3 mpd* |

DBS Vantage DBS Vantage | 1.5 mpd | 2.2 mpd |

OCBC VOYAGE OCBC VOYAGE | 1.3 mpd | 2.2 mpd |

HSBC VI HSBC VI | Up to 1.25 mpd^ | Up to 2.25 mpd^ |

UOB VI Metal Card UOB VI Metal Card | 1.4 mpd | 2 mpd |

Citi Prestige Citi Prestige | 1.3 mpd | 2 mpd |

Maybank VI Maybank VI | 1.2 mpd | 2 mpd |

AMEX Plat. Reserve AMEX Plat. Reserve | 0.69 mpd | 0.69 mpd |

| *Min. S$2,000 spend per statement month, otherwise 1 mpd for both SGD and FCY ^Min S$50,000 spend in the previous membership year, otherwise 1 mpd (SGD) and 2 mpd (FCY) | ||

Bonus Spend

The OCBC VOYAGE does not have a bonus spend category (though the PPC version does earn 2.3 mpd on local and overseas dining).

That’s kind of a bummer, because it makes it really hard to rack up valuable VOYAGE Miles in any significant quantity.

When are VOYAGE Miles credited?

VOYAGE Miles are credited when your transaction posts, which generally takes 1-3 working days.

How are VOYAGE Miles calculated?

Here’s how you can work out the VOYAGE Miles earned on your OCBC VOYAGE.

| Local Spend | Round down transaction to nearest S$5, divide by 5, multiply by 6.5. Round to the nearest whole number |

| FCY Spend | Round down transaction to nearest S$5, divide by 5, multiply by 11. Round to the nearest whole number |

One annoying thing about the VOYAGE (and all OCBC cards for that matter) is that transactions are rounded down to the nearest S$5. That means a S$14.90 transaction earns the same number of miles as a S$10 transaction, and a S$4.99 transaction earns no miles at all!

This rounding policy means that even though the OCBC VOYAGE may have the same headline earn rate as a competitor, the actual number of miles earned will be smaller. Below is a comparison with the Citi Prestige, which also offers 1.3 mpd on local spending.

OCBC VOYAGE OCBC VOYAGEEarn Rate: 1.3 mpd |  Citi Prestige Citi PrestigeEarn Rate: 1.3 mpd | |

| S$5 | 7 miles | 6.4 miles |

| S$9.99 | 7 miles | 11.6 miles |

| S$15 | 20 miles | 19.6 miles |

| S$19.99 | 20 miles | 24.8 miles |

| S$25 | 33 miles | 32.4 miles |

| S$29.99 | 33 miles | 37.6 miles |

If you’re an Excel geek, here’s the formulas you need to calculate points:

| Local Spend | =ROUND (ROUNDDOWN(X/5,0)*6.5,0) |

| FCY Spend | =ROUND (ROUNDDOWN(X/5,0)*11,0) |

| Where X= Amount Spent | |

For the full list of formulas that banks use to calculate credit card points, do refer to these articles:

What transactions aren’t eligible for VOYAGE Miles?

A full list of ineligible transactions to earn VOYAGE Miles can be found in the OCBC VOYAGE T&Cs.

I’ve highlighted a few noteworthy categories below:

- Educational Institutions (MCC 8211-8299)

- Donations (MCC 8398)

- Government Services (MCC 9000-9999)

- Insurance (MCC 6300)

- Professional Services and Membership Organizations (MCC 8651-8661)

- Quasi cash transactions (MCC 6529-6540)

- Real Estate Agents and Managers (MCC 6513)

- Top-ups to prepaid accounts like YouTrip and GrabPay

- Utilities payments (MCC 4900)

For avoidance of doubt, OCBC VOYAGE cards will earn miles with CardUp. There have even been special tie-ups in the past that give VOYAGE cardholders a discount on the admin fee.

What do I need to know about VOYAGE Miles?

| ❌ Expiry | ↔️ Pooling | ✈️ Transfer Fee |

| No expiry | No | None |

Expiry

VOYAGE Miles earned on the OCBC VOYAGE do not expire, so long as the card remains active.

Pooling

VOYAGE Miles are a unique currency earned only on the OCBC VOYAGE, and since you can only hold one VOYAGE card at a time, the question of pooling is irrelevant.

Transfer Fees & Partners

OCBC VOYAGE only has a single transfer partner: Singapore Airlines KrisFlyer.

| Frequent Flyer Programme | Conversion Ratio (VOYAGE Miles: Partner) |

| 1:1 |

VOYAGE Miles transfer at a 1:1 ratio, with a minimum transfer of just 1 VOYAGE Mile. Transfers used to be free of charge, but now have a S$25 admin fee.

While this has been a key weakness of the VOYAGE for some time now, the situation is set to improve by March 2023 when OCBC adds eight new airline and hotel transfer partners

Other card perks

VOYAGE Exchange

One of the most unique features of the OCBC VOYAGE is the ability to redeem VOYAGE Miles for any seat, on any flight, to any destination. This is basically using VOYAGE Miles like cash.

To be clear, redeeming VOYAGE miles is not the same as redeeming KrisFlyer miles.

| Redeem VOYAGE Miles | Redeem KrisFlyer miles | |

| Airline | Any airline | Any KrisFlyer partner |

| Seat Availability | Any seat available for sale | Award inventory only |

| Miles Required | Depends on cost of ticket | Fixed based on award chart |

| Taxes & Surcharges | Can be covered by miles | Paid in cash |

| Earn Miles & Status Credits | Yes | No |

VOYAGE Miles can be redeemed for any airline available through the VOYAGE Exchange (which would include every major carrier worldwide). KrisFlyer miles can be redeemed for Singapore Airlines or any of its Star Alliance/non-Star Alliance partners (which totals ~30 at last count).

When you redeem VOYAGE Miles, you have access to any seat available for sale. When you redeem KrisFlyer miles, you’re limited to the space that airlines have set aside for awards.

The number of VOYAGE Miles required depends on the cost of the ticket. If the ticket is more expensive, you’ll need more VOYAGE Miles. If the ticket is cheaper, fewer VOYAGE Miles. With KrisFlyer, the number of miles is fixed according to the award chart.

VOYAGE Miles can be used to pay taxes and surcharges for tickets, but if you redeem KrisFlyer miles, you’ll need to pay for these with cash.

| ⚠️ You can, but shouldn’t! |

While you can use your VOYAGE Miles to pay for taxes and surcharges, you probably shouldn’t. OCBC uses a different valuation for VOYAGE Miles when used for fares, as compared to taxes and surcharges, and the rate used for the latter is very poor (presumably because they’re non-commissionable). Always opt to pay these in cash. |

Since tickets purchased through the VOYAGE Exchange are basically the same as a cash ticket, you’ll earn miles and elite status credits as per the fare class. KrisFlyer redemption tickets do not earn miles or elite status credits.

Long story short, each route has their own advantages. If you use VOYAGE Miles, you enjoy better availability and miles/elite status accrual, but lower value on a per mile basis. If you use KrisFlyer miles, you have less availability and no miles/elite status accrual, but higher value on a per mile basis.

So the question then becomes: what’s the value of a VOYAGE Mile when redeemed through VOYAGE Exchange?

The answer is it varies. According to some research I did in 2018, the value of a VOYAGE Mile depends on:

- What destination you’re flying to

- What cabin you’re flying in

That’s to say, VOYAGE Miles might command a fixed value of X cents each when redeemed for Business Class travel to anywhere in the Europe zone. More recent reports have pegged the value at 1.9-2.2 cents per mile for Business Class travel, and 2.3-2.6 cents per mile for First Class.

It is also possible to redeem VOYAGE Miles via Travel with OCBC, where the value appears to be fixed at 2.19 cents per VOYAGE Mile. However, it’s advisable to cross check the fare quotes on Travel with OCBC against the airline’s official website and make sure you’re not paying over the odds.

Complimentary Airport Limo

OCBC VOYAGE cardholders will receive one complimentary limo ride with a minimum spend of S$5,000 per calendar month. A maximum of two rides can be earned each month.

VOYAGE limo rides are valid for trips to:

- Changi Airport

- Seletar Airport

- Marina Bay Cruise Centre

- Singapore Cruise Centre

- Tanah Merah Ferry Terminal

- Queen Street Bus Terminal

Cardmembers can use the limo service before the minimum spend amount is met. At the end of the calendar month, charges will be waived based on the entitlements earned. If limo rides in excess of entitlements are used, a S$60 fee will be charged per transfer.

A S$5,000 minimum spend is one of the highest on the market, unfortunately. Even the Citi Prestige’s frightening-sounding S$12,000 is lower once you adjust for time period and number of rides.

Unlimited Complimentary Lounge Visits

OCBC VOYAGE cardholders (both principal and supplementary) enjoy unlimited visits to more than 110 Plaza Premium Lounges at 52 airports worldwide.

While Plaza Premium Lounges are normally a cut above your typical airport contract lounge, the footprint isn’t anywhere as big as Priority Pass or LoungeKey. Travellers to Phuket, Los Angeles, Manchester and Frankfurt won’t have any lounge options, to name a few.

If it’s any consolation, this may change soon. Plaza Premium recently announced a partnership with DragonPass that aims to create a 1,500+ lounge network by 2025. I’ve confirmed with DragonPass that cardholders with Plaza Premium entitlements will get access to the DragonPass global network “in the near future”.

VOYAGE Payment Facility

The VOYAGE Payment Facility is positioned as a way for VOYAGE cardholders to pay their bills and earn miles in the process.

In reality, however, you don’t need a bill to pay. The VOYAGE Payment Facility is a “no questions asked” way of buying miles, with a price ranging from 1.9 to 1.95 cents apiece.

| Amount | Admin Fee |

| S$10,000 to S$150,000 | 1.95% |

| S$150,100 and above | 1.9% |

A minimum of S$10,000 must be charged, in increments of S$100. 1 VOYAGE mile will be awarded for every S$1 charged to the payment facility.

For example:

- A cardholder submits a form with a request for S$100,000

- OCBC charges S$101,950 to his OCBC VOYAGE Card (S$100,000 + 1.95% fee)

- OCBC credits S$100,000 to his designated bank account and awards 100,000 miles

- He uses the S$100,000 to pay off his VOYAGE card

- Nett cost= S$1,950 for 100,000 miles, cost per mile= 1.95 cents

Up to 90% of one’s credit limit can be requested through the VOYAGE Payment Facility.

Assuming you can obtain >1.95 cents per mile of value when redeeming VOYAGE Miles, there could actually be an arbitrage opportunity here (if you pay 1.95 cents per mile and redeem at 2.19 cents per mile, you’re basically saving ~11% off airfares).

1-for-1 dining offers

VOYAGE cardholders receive periodic 1-for-1 offers at fine dining restaurants (such as Peach Blossom and Iggys), through the Epicure by VOYAGE programme.

These offers are first-come-first-serve, and get sold out very quickly. To improve your chances of snagging a slot, subscribe to the OCBC VOYAGE Telegram Group, where news about these offers breaks first.

Summary Review: OCBC VOYAGE

| |||

| Apply Here |

The OCBC VOYAGE offers competitive earn rates (assuming the S$5 earning blocks don’t bother you) and a minimum conversion block of just 1 mile. However, the truly unique feature is VOYAGE Miles, and I’d go so far as to say that if you’re just converting them into KrisFlyer miles, you’re not making full use of this card.

Some weaknesses like the lack of transfer partners and small lounge footprint will be addressed in due course- the former by the end of 2022, the latter when DragonPass opens up its network to those with Plaza Premium access. However, other drawbacks like the high minimum spend for a free limo ride and the lack of bonus categories don’t look like they’ll be fixed anytime soon, and may weigh more heavily on the minds of certain cardholders.

tl;dr: I wouldn’t consider the OCBC VOYAGE as the clear leader of the $120K card pack, but at least it’s not just there to make up the numbers.

So that’s my review of the OCBC VOYAGE. What do you think?

| Overall Score | |

| ★★★1/2 | |

| Ratings Guide | |

| 5 Stars ★★★★★ | An essential card for miles chasers, with few viable alternatives |

| 4 Stars ★★★★ | A very good card, although other equally good alternatives may exist |

| 3 Stars ★★★ | A decent card to round out your collection, but not absolutely essential |

| 2 Stars ★★ | Very limited use cases, and outperformed by most other cards |

| 1 Star ★ | Paperweight. Use for picking teeth or ninja stars |

Might be important to note that TravelwithOCBC is operated by Ascenda and different from Voyage Exchange.

This is a great point, thanks for sharing!

So, a hard-to-earn dynamic pricing currency that is based on non-transparent rates, what’s not to like?

if you use voyage miles to redeem a business class ticket with SIA do you get PPS value?

Yes

Questions

1) Does VOYAGE Payment Facility transfers count towards the annual $60,000 spent?

2) Does it make sense to use the above (1) to get the annual fee waiver

3) Is it better to pay annual fees for the 15,000 miles since it has no expiry date

Am considering between OCBC VOYAGE for its 30,000 bonus miles or should I go for OCBC Premier VOYAGE straight?

Thank you in advance for your view 😉

Do note that OCBC deems a Toyota Alphard / Vellfire to be similar to a Toyota Noah… Surprised at the downgrade.