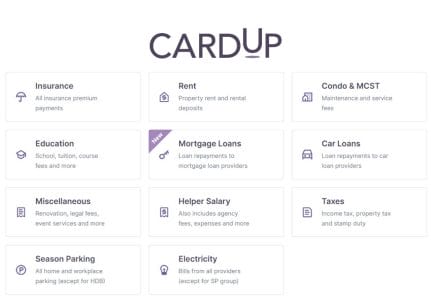

If you’re looking to earn miles on bills like insurance premiums, tuition fees, income tax, rental, utilities etc., CardUp offers a way of doing so in exchange for a small fee.

Whether or not this makes sense ultimately boils down to your valuation of a mile, but with the right card and promo codes, most people should be able to make the math work.

In this post we’ll answer some common questions about CardUp, as well as which cards and promo codes help you achieve the lowest cost per mile.

| ❓ What is CardUp? |

CardUp is a bill payment platform that allows users to pay rent, income tax, insurance premiums, MCST fees, season parking, mortgage installments and more with their credit card, earning miles in exchange for a small fee. CardUp will make a bank transfer on your behalf, and the receiving party need not be registered with CardUp. First-time CardUp users can use the promo code MILELION to save S$30 off their first payment, with no minimum payment required. |

Common CardUp questions

Before we look at the best cards to use for CardUp, let’s tackle three common questions.

Does CardUp earn credit card rewards?

Yes, with two exceptions:

- HSBC cards no longer earn rewards on CardUp transactions (since July 2020)

- The UOB One Credit Card no longer offers cash rebates on CardUp transactions (since August 2022)

All other cards and card issuers continue to award miles, points and cashback on CardUp transactions as per normal.

Unfortunately, bank CSOs will sometimes misinform customers that CardUp transactions aren’t eligible to earn points. There’s not a whole lot that can be done about that, sadly, but you can find many data points of successful points crediting with various banks in the Telegram Group.

Does CardUp count towards minimum spend for sign-up bonuses and card benefits?

Generally yes, though some exceptions apply:

- For DBS cards, only CardUp rental transactions will count towards the minimum spend for sign-up bonuses. All other CardUp payments e.g. insurance, education, donations will not count towards minimum spend, though they still earn base rewards

- Historically speaking, certain Standard Chartered X Card and UOB PRVI Miles sign-up offers have excluded CardUp spending. However, this exclusion is not consistent, so you’ll need to refer to individual promotion T&Cs

- CIMB does not include CardUp transactions in minimum spend for bonus cashback

Otherwise, CardUp transactions are treated like regular retail spend and count towards the minimum spend for sign-up bonuses and card benefits.

Does CardUp qualify for bonus points/miles?

No.

Even though CardUp transactions code as online spend, they will not earn 4 mpd with cards like the Citi Rewards Card, DBS Woman’s World Card or UOB Preferred Platinum Visa.

You should stick to general spending cards for CardUp.

What’s the best card to use with CardUp?

Since CardUp is basically a way of buying miles, the best card to use for CardUp is the one that gives the lowest cost per mile.

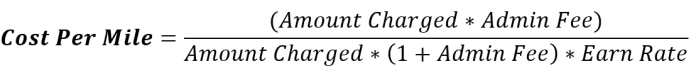

|

Two things to note about the above formula:

- Both the amount charged and the CardUp admin fee are eligible to earn miles. For example, if I charge S$1,000 to CardUp with a 2.6% admin fee, the full S$1,026 amount will earn miles

- The formula does not take into account the impact of rounding. For example, if I charge a S$1,026 CardUp transaction to a UOB card, I will only earn miles based on S$1,025 (because UOB rounds all transactions down to the nearest S$5). However, the impact of rounding becomes less significant as the amount charged increases

What this formula shows is that we can lower the cost per mile by:

- Maximising the earn rate

- Minimising the admin fee

Maximising the earn rate

Since CardUp transactions do not earn bonus points/miles, the equation becomes very simple: Use the highest-earning general spending card you have.

| Card | Earn Rate | Cost Per Mile (based on 2.25% fee) |

DBS Insignia DBS Insignia | 1.6 | 1.38 |

DBS Vantage DBS Vantage | 1.5 | 1.47 |

UOB PRVI Miles Card UOB PRVI Miles Card | 1.4 | 1.57 |

Citi Prestige Citi Prestige | 1.3 | 1.69 |

OCBC Premier Visa Infinite OCBC Premier Visa Infinite | 1.28 | 1.72 |

DBS Altitude DBS Altitude | 1.2 | 1.83 |

BOC Elite Miles BOC Elite Miles | 1.0 | 2.20 |

I’m not bothering to list every single general spending card out there (so please don’t flood the comments with “what about Card X?”), because that’d just be repetitive. If you know your earn rate, you can match it to the table above to derive the cost per mile.

The general rule is that the higher the earn rate, the lower the cost per mile.

Minimising the admin fee

As important as earn rates are, they’re just part of the picture because the admin fee also dictates the final cost per mile.

CardUp’s standard admin fee is 2.6% for locally-issued American Express, Mastercard and Visa cards. However, this is frequently discounted; in fact, the de facto fee for Mastercard and Visa is pretty much 2.25%.

Here’s the list of current promotions at the time of publishing; you can refer to this page for the latest.

| Code | New Users | Existing Users |

| MILELION S$30 off any payment, Visa & MC (T&Cs) | ✓ | ✕ |

| MLTAX23 1.75% fee for income tax payments, Visa only (T&Cs) | ✓ | ✓ |

| GET225 2.25% fee for any payment, Visa & MC (T&Cs) | ✓ | ✓ |

| RECURRING185 1.85% fee for recurring payments, Visa only (T&Cs) | ✓ | ✓ |

| SAVERENT179 1.79% fee for rent payments, Visa & MC (T&Cs) | ✓ | ✓ |

| OCBC15 1.5% fee for any payment, OCBC VOYAGE & Premier Visa Infinite (T&Cs) | ✓ | ✕ |

| OCBC18 1.8% fee for any payment, OCBC VOYAGE & Premier Visa Infinite (T&Cs) | ✓ | ✓ |

| OCBC90N15 1.5% fee for any payment, OCBC 90°N Cards (T&Cs) | ✓ | ✕ |

| OCBC90NV 2% fee for any payment, OCBC 90°N Visa (T&Cs) | ✓ | ✓ |

| OCBC90NMC 2% fee for any payment, OCBC 90°N Mastercard (T&Cs) | ✓ | ✓ |

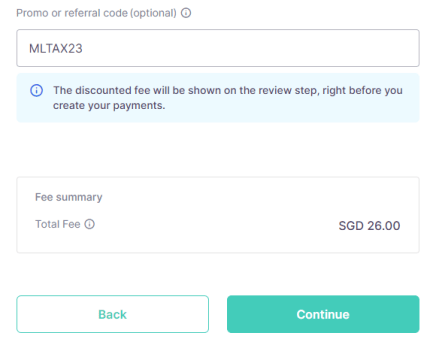

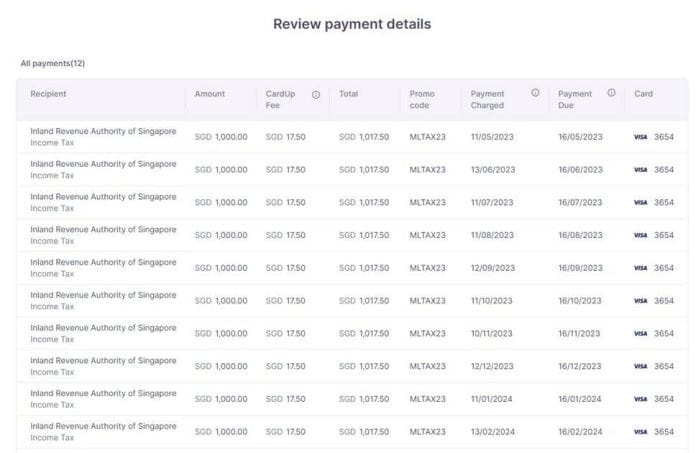

Promo codes can be applied when setting up a CardUp transaction.

You’ll see the discounted price reflected on the final screen.

What about Citi PayAll?

It should be mentioned that CardUp may not necessarily be the cheapest way of earning miles on bill payments. Citi PayAll, Citibank’s competing service, runs periodic promotions that are usually the best in the market.

|

| Citi PayAll 2.2 mpd Promo |

For example, from now till 20 August 2023, Citi PayAll is offering a flat 2.2 mpd earn rate on all transactions, with an admin fee of 2.2%. A minimum spend of S$8,000 and a cap of S$120,000 applies.

This works out to 1 cent per mile, lower than any competing service- provided you can meet the minimum spend.

Refer to this article for the full details.

Conclusion

If you want to earn miles on bill payments, then services like CardUp are pretty much the only option at the moment (RIP GrabPay x AXS).

The idea is to reduce the cost per mile as much as possible, which we do by using the highest-earning general spending card we have, and paying the lowest possible admin fee with promo codes.

CardUp transactions are still eligible to earn rewards with all cards on the market except HSBC, and the UOB One Card, so there’s plenty of options.

Probably good to clarify that other UOB cards will only award Based points for cardup transaction.

Tested with EVOL, not recognised as “online” category.

CardUp = 2.25% fee -> 1.84 cpm

(Miles awarded include fees)

Citi PayAll = 2.2% fee -> 1.83 cpm

(Miles awarded exclude fees)

Ever since Citi PayAll increases the fee from 2% to 2.2%, It is clear that I will be using CardUp in the future as miles awarded do include fees on CardUp. (To add on: Income tax = 1.75% fee using VISA cards)

Forget about the Citi PayAll 2.2 mpd promo – I can never hit the $8k spend on Citi PayAll payments!

Edit: Just realised CardUp doesn’t support payments to SP group for electricity and utility bills. Oh well, back to using Citi PayAll for those payments! 🙁

Will be using CardUp for the upcoming income tax though for the cheaper 1.75% fee.